Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Europe is “OK” Again – No Reason

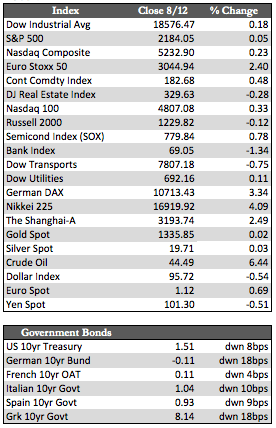

Once again the trading action in US stocks slanted toward dull this week as the indices essentially moved sideways. By the looks of it, subsiding concerns over the Brexit situation and a pledge to stabilize oil supplies by a high-ranking energy official in Saudi Arabia might have caused some flight capital to leave the US and return to European markets. Though I can’t prove it, that could explain why European stocks ended higher by a few percent while US stocks stagnated. If true, then one of the major pillars of support (along with corporate share buybacks) in this US stock rally (which has defied a 22% overall contraction in earnings) may be in the process of being removed.

On the subject of earnings, there were a few things that caught my eye within the retail sector this week. Kohl’s and Macy’s both were able to win at the game of “beat-the-number,” though revenues of each were lower year over year. The former used a share buyback plan to boost earnings and the latter is planning 100 store closures. The fact that shares of both companies jumped 17.0% higher had me a bit perplexed. Despite claims to the contrary, neither really has a growth strategy online to offset losses from brick and mortar stores. So I assumed that this was yet another case of “the worst is over” by the bulls. Keeping in mind that I could have been wrong in that assumption, it was the very next day that US retail sales figures registered 0.0% growth for July, except that auto and gas sales were 0.1% lower. This supports my assumption, and further indicates that the economic benefit we’ve seen from ultra-low rates will fade faster than bulls expect.

On the subject of earnings, there were a few things that caught my eye within the retail sector this week. Kohl’s and Macy’s both were able to win at the game of “beat-the-number,” though revenues of each were lower year over year. The former used a share buyback plan to boost earnings and the latter is planning 100 store closures. The fact that shares of both companies jumped 17.0% higher had me a bit perplexed. Despite claims to the contrary, neither really has a growth strategy online to offset losses from brick and mortar stores. So I assumed that this was yet another case of “the worst is over” by the bulls. Keeping in mind that I could have been wrong in that assumption, it was the very next day that US retail sales figures registered 0.0% growth for July, except that auto and gas sales were 0.1% lower. This supports my assumption, and further indicates that the economic benefit we’ve seen from ultra-low rates will fade faster than bulls expect.

Away from stocks, Treasuries and other sovereign debt in Europe inched higher as stocks here in the US stalled and oil bounced. The dollar and the metals remained range bound, though I expect that to change when it becomes difficult for US corporations to live up to their lofty third quarter earnings expectations. Incidentally, earnings for this latest quarter (Q2) could be down as much as 3.5% on a year over year basis – that’s with about 10% of companies in the S&P 500 having yet to report. I find that interesting given the highs set in stocks and the fact that, despite the relative quiet in terms of news right now, US stocks didn’t, or perhaps couldn’t, build on any momentum.

Best Regards,

David Burgess

VP Investment Management

MWM LLC