Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Next Up: Earnings

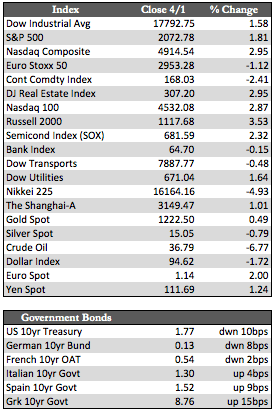

Yellen’s dovish remarks on Tuesday set the tone for trade across global equity markets this week as she emphasized that “caution” will be “especially warranted” in regard to rate hikes this year and next. She cited the deterioration in the outlook for global growth as her primary reason for the change in tone, but I don’t know why anyone would be surprised by her comments. She skews dovish most of the time. Nonetheless, the US dollar entered into a tailspin along with foreign equity markets except China’s, where stocks managed a small gain thanks to some rather obscure, upbeat manufacturing data. Stocks here in the US responded quite differently, interpreting Yellen’s comments to indicate that money printing is again right around the corner. Major indices here climbed steadily, overcoming a few bad openings along the way, to finish up a couple of percent by the close on Friday. Trading volumes remained below average across the board, while the Transport index finished with a loss, extending a bearish move that began last week.

Away from stocks and the dollar, Treasuries and foreign debt had a good week. It’s hard to tell exactly why, whether it was the prospect of slower economic growth or the increasing dovishness of central banks. As to the latter, I don’t think it will be long before faith in central banks and their ability to foster “growth” begins to crack. The ECB has become the most recent central bank to see unprofitable results after opening its QE floodgates a few weeks ago – those results being a stronger euro and weaker equity markets. Keep in mind that QE once tended to have a positive and widespread effect on everything in the markets – unlike today, where the effects are increasingly fragmented. Oil, gold, and silver had mixed results, even as the dollar lost considerable ground. Aside from oil’s supply issues, I suspect that commodities behaved poorly because hot money typically chases (only) stocks when the Fed starts to coo. However, I believe we are drawing closer to a point in time when this phenomenon will change.

Away from stocks and the dollar, Treasuries and foreign debt had a good week. It’s hard to tell exactly why, whether it was the prospect of slower economic growth or the increasing dovishness of central banks. As to the latter, I don’t think it will be long before faith in central banks and their ability to foster “growth” begins to crack. The ECB has become the most recent central bank to see unprofitable results after opening its QE floodgates a few weeks ago – those results being a stronger euro and weaker equity markets. Keep in mind that QE once tended to have a positive and widespread effect on everything in the markets – unlike today, where the effects are increasingly fragmented. Oil, gold, and silver had mixed results, even as the dollar lost considerable ground. Aside from oil’s supply issues, I suspect that commodities behaved poorly because hot money typically chases (only) stocks when the Fed starts to coo. However, I believe we are drawing closer to a point in time when this phenomenon will change.

As we head into next week, we’ll see if the upcoming earnings season will give stock bulls pause or reason to suspend belief for another quarter and thereby extend recent gains. Earnings expectations have already been ratcheted down several times, but analysts are still expecting solid growth of 12.6% on a year-over-year basis and a whopping 31.3% quarter-to-quarter. Given last year’s unseasonably bad weather, it’s possible that some corporations might be able to live up to such expectations. But given how bad things were just a quarter ago, combined with the fact there is still no money coming in from the Fed, I doubt the majority of them will.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP