Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Ramp to Nowhere

Over the past few weeks US stocks underwent a fairly sizeable run-up to the Fed’s rate decision Thursday, which turned out to be a non-event. The Fed kept rates unchanged, citing international rather than US economic concerns. However, this will probably be the last time the Fed will be able to throw China under the bus. Conditions here in the US have been getting worse since the small post-winter bounce the economy had in the middle of this year. US retail sales (+0.2%, down from 0.7% in July) and manufacturing growth fell back again in August, while Fed surveys suggest those trends will extend into September. We also had another round of corporate preannouncements in which Citigroup, FedEx, and Verizon all lowered guidance. Then of course there was Hewlett Packard’s planned intention to furlough 30,000 people. All that is to say that what the markets really needed was more QE. Without it, stocks began to leak again after the Fed’s press conference.

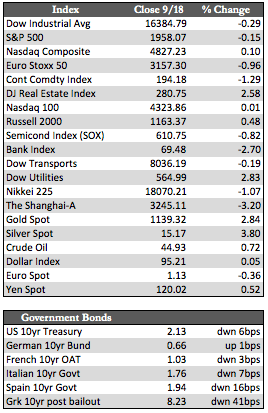

After all that volatility, stocks finished flat for the week alongside Treasuries and the dollar. Treasuries were clobbered disproportionately during the Dow’s 240-point rally Tuesday, which prompts a question: If bonds fell hard in anticipation of dovish talk from the Fed, what kind of losses can we expect in the face of actual QE? This is not the first time the bond market has acted strangely, and I suspect it won’t be the last. As I have stated here several times before, the Fed is losing or may have already lost its ability to effectively promote growth from an economic perspective.

After all that volatility, stocks finished flat for the week alongside Treasuries and the dollar. Treasuries were clobbered disproportionately during the Dow’s 240-point rally Tuesday, which prompts a question: If bonds fell hard in anticipation of dovish talk from the Fed, what kind of losses can we expect in the face of actual QE? This is not the first time the bond market has acted strangely, and I suspect it won’t be the last. As I have stated here several times before, the Fed is losing or may have already lost its ability to effectively promote growth from an economic perspective.

The precious metals and the miners began to perk up this week. More significantly, the metals held their gains while other commodities, especially oil, fell in concert with stocks on Friday. That action may have been due to short covering, but I think it’s fair to take the consistency of the move in the metals this week as an indication that a strong “flight to safety” bid is now in the making. Stocks are hanging in the balance with no support from the Fed, so my assessment will likely be tested by events in the days leading into October. That month is traditionally a shaky time of the year for stocks, and it seems likely to fulfill expectations again this year.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP