Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stock Bulls Hold the Line

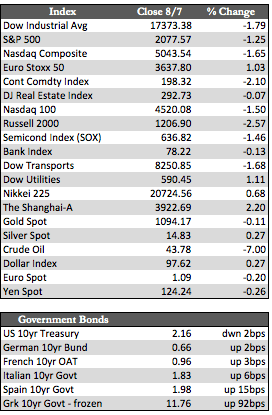

With most of an unimpressive earnings season now behind us and with today’s relatively benign NFP report (which reinforced expectations of Fed rate hikes projected for September), a correction of 10% or more in stocks is looking probable. As if to confirm that predilection, this week we had an increase in defensive posturing away from stocks and toward Treasuries – and to a lesser degree toward gold – even as the dollar managed a small gain for the week.

Stock bulls remain surprisingly unfazed. In fact, to this point they seem unfazed by anything, emboldened of course by the “success” in new era stocks such as Netflix, Google, Amazon, Facebook, and Priceline, as well as by central bank dovishness worldwide (with only a few exceptions). However, with the broader scope of S&P 500 companies on track for a 3.1% decline in revenues for a second straight quarter, a relatively strong dollar, and the growing ineffectiveness of QE in general, there appears to be sufficient undertow to drag under a sustained rally in stocks between now and year-end.

Stock bulls remain surprisingly unfazed. In fact, to this point they seem unfazed by anything, emboldened of course by the “success” in new era stocks such as Netflix, Google, Amazon, Facebook, and Priceline, as well as by central bank dovishness worldwide (with only a few exceptions). However, with the broader scope of S&P 500 companies on track for a 3.1% decline in revenues for a second straight quarter, a relatively strong dollar, and the growing ineffectiveness of QE in general, there appears to be sufficient undertow to drag under a sustained rally in stocks between now and year-end.

In any case, the S&P 500 fell below, flirted with, and then rose above its 200-day moving average by day’s end on Friday. Traders likely had some consensus on defending that line in front of the “no news” period that essentially begins next week. At that time we’ll have a better idea if the bulls can stage a rebound, or if any and all rallies will effectively be sold – as they have been thus far.

The metals appear to be striving to avoid any precipitous fall, due in part to the subtle shift in psychology I believe is now underway in stocks. Physical demand at the U.S. mint improved quite a bit in July, rising 469.0%. That was compared to a relatively low base the previous year, but it may be a sign of better things to come – certainly if trade volumes can show a steady increase.

There is no recap planned for next week, as we will be hosting our annual client conference here in Durango. That said, I may offer some remarks if market conditions dictate.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP