Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Overdressed for the Wrong Occasion

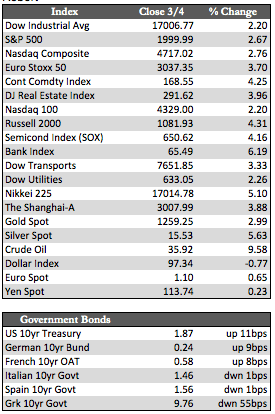

Stocks both here and abroad saw a little more momentum to the upside this week as the major indices tacked on a couple of percent – for no good reason that I could see. The rally appears to have been technical through and through. The price movement fed on itself, fueled by first-of-the-month fund flows and moving-average “breakouts” – all at the expense of those short in the oversold areas of technology, energy, the financials, and perhaps some of the industrials. As the week drew to a close, we saw what could be profit taking in such things as the FANGs, healthcare, and biotech. That may be an indication that we’ve entered the final stages of this rally before prices begin to roll over again – as I fully expect.

As stocks clawed their way higher, sovereign debt markets (including Treasuries) reluctantly gave up a portion of recent gains, while the balance of economic data released pushed most foreign currencies up against the dollar. That, along with some technical breakthroughs, helped gold rally just shy of 3.0% to silver’s 5.63%, while the miners averaged just over 6.0%.

As stocks clawed their way higher, sovereign debt markets (including Treasuries) reluctantly gave up a portion of recent gains, while the balance of economic data released pushed most foreign currencies up against the dollar. That, along with some technical breakthroughs, helped gold rally just shy of 3.0% to silver’s 5.63%, while the miners averaged just over 6.0%.

Now that stocks have rallied, payrolls have firmed (242,000 vs. expectations of 195,000 for February), and sentiment has improved somewhat, the Fed will likely be feeling hawkish in the next FOMC meeting on March 16th. That combined with the earnings picture outlined in last week’s recap and the still massive oversupply issues facing oil suggest stocks are in for some real challenges in the near term. Still, given the lunacy we’ve seen in equity markets (and the media) over the last few weeks, one can never be too sure. The tendency to suspend reality can last much longer than anyone originally expects.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP