Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Say, “Who Cares?”

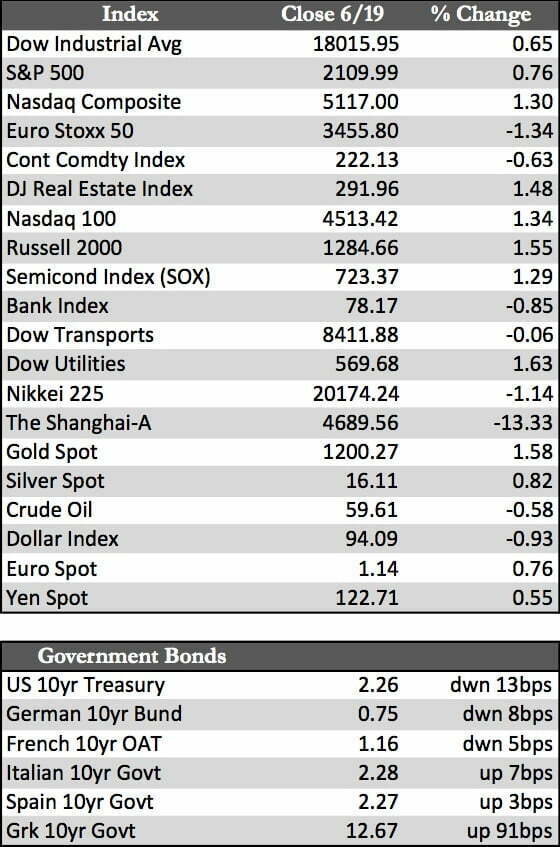

Dovishness from the Fed and an ECB emergency extension of Greece’s funding kicked off a fairly sizeable rally in both U.S. equities and bond markets worldwide. Yellen made remarks during her press conference about raising rates “gradually,” which the media took and ran with. However, the Fed made it clear in its official statement that two rate increases would be expected by year-end – as planned. Clearly, stocks preferred the press’s version to the official line. My estimation is that the Fed is trying to act wisely, saving its monetary bullets for a time when they will be most effective – at a market low. As for Greece, I still believe its situation is small potatoes compared to ineffectual QE results in the markets of Europe, China, and Japan. That said, whether Greece stays in the eurozone or defaults (I believe the latter is inevitable at this point) won’t matter much down the road. But given that Greece occupies the headlines, it offers a nice diversion from starker realities – momentarily.

Away from those fireworks, the passage of the “Fast Track” trade bill by the U.S. House on Thursday appeared to have a positive impact on the market, albeit momentarily. Once it was determined that the bill was a vote against US jobs, its impact on our markets was muted. And for those still dreaming of a second-half recovery, the results in May still say go away. U.S. industrial production fell 0.2% and inflation rose, with the CPI gaining 0.4% (the largest increase since 2013). Lower production and higher inflation negates the efficacy of QE as a catalyst for growth – hence the Fed remains trapped.

Away from those fireworks, the passage of the “Fast Track” trade bill by the U.S. House on Thursday appeared to have a positive impact on the market, albeit momentarily. Once it was determined that the bill was a vote against US jobs, its impact on our markets was muted. And for those still dreaming of a second-half recovery, the results in May still say go away. U.S. industrial production fell 0.2% and inflation rose, with the CPI gaining 0.4% (the largest increase since 2013). Lower production and higher inflation negates the efficacy of QE as a catalyst for growth – hence the Fed remains trapped.

Put a summation sign next to all of this and it tots up to growing uncertainty, which may be why the metals perked up this week. Gold closed above $1,200 – up about 1.5% – which helped the miners finish with a gain of 3.0%, give or take. Silver struggled, though I believe the behavior is not only normal but temporary, as a demand shift from industrial to monetary may be underway. On Monday, we’ll see if Greek government officials can stand their ground when so many internal and external forces are arrayed against them. Nothing short of debt restructuring and/or an abandonment of the euro will do for Greece’s future, as I see it. But the universal tendency to be shortsighted in situations like this may prevail, in which case all we can do is wait and see.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP