Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Struggle on Election

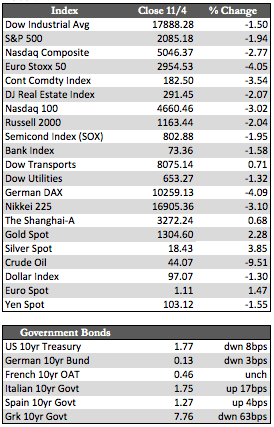

Much like last Friday when the FBI case against Hillary Clinton was reopened, stocks both here and abroad continued to lose ground in anticipation of a possible Trump win. Depending on the exchange, stocks lost as much as 5.8% in Italy and as little as a 1.5% (in the Dow) here in the US. The only exception was the Dow transports, where a gain of about 0.70% was had on the back of some marginally better third quarter numbers (even though forward guidance was lowered) at a few car rental agencies. Of course, I really don’t think these highly leveraged – and therefore fragile – markets need a reason to tumble. An election outcome or something similar could trigger a downturn, but to say that it’s the cause would be stretching it a bit. Certainly larger problems can be found by anyone paying attention – chief among them the not-so-small backup in bond markets across the globe, particularly throughout Europe.

Considering these and other related items in the news, I still don’t have a great feel for where markets will head between now and year-end. That goes for stocks, bonds, and the metals, as the always-pressing need to game performance will begin to take precedence over any and all macro fundamental issues. There is one thing that I can say with relative confidence as we close out the year: The correction in gold has seen its lows (around $1,250). Even with the specter of a Fed rate hike looming in December, I believe there’s a strong chance the market will interpret the hike (if it even happens) to be the Fed’s last for a while. That combined with the recent steady increase in ETF ounces under management and the fact that the metals are the best-performing assets year-to-date means we could see them outperform into year-end.

Considering these and other related items in the news, I still don’t have a great feel for where markets will head between now and year-end. That goes for stocks, bonds, and the metals, as the always-pressing need to game performance will begin to take precedence over any and all macro fundamental issues. There is one thing that I can say with relative confidence as we close out the year: The correction in gold has seen its lows (around $1,250). Even with the specter of a Fed rate hike looming in December, I believe there’s a strong chance the market will interpret the hike (if it even happens) to be the Fed’s last for a while. That combined with the recent steady increase in ETF ounces under management and the fact that the metals are the best-performing assets year-to-date means we could see them outperform into year-end.

Best Regards,

David Burgess

VP Investment Management

MWM LLC