Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Cheaper Gas Doesn’t Always Equate to Growth

In the early going this week, stocks lost considerable ground on the back of fairly disappointing retail sales figures during the holiday shopping season. Over the four-day stretch that included Black Friday, sales were down by $6.4 billion to $51.0 billion at brick and mortar stores, while the much hyped cyber sales rose only $300.0 million to $2.0 billion. When combined, sales slid by 10.3% year-over-year, even as gas prices fell below $3 per gallon across several states (and below $2 in some).

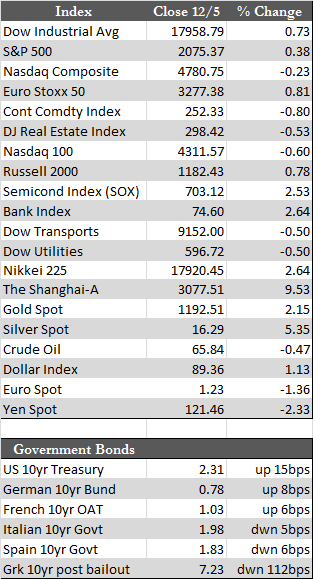

As the week wore on, stocks erased some of those losses leading into the ECB policy meeting – which turned out to be a non-event. Draghi, in the absence of German support, postponed any and all QE decisions into early next year. Then, at week’s end, the US jobs report released an eye-popping 321,000 non-farm payroll gain for the month of November. That piece of news helped stocks finish the week mixed, with the Dow up a little over half a percent and the NASDAQ down by roughly the same. Away from stocks, Treasuries foundered, probably due to record issuance. The dollar rose primarily against the yen as authorities in Japan eyed a 125.0 yen per dollar exchange rate as a near-term policy target. Despite the dollar’s spike, gold, silver, and the miners rallied and outperformed most assets for the week.

As the week wore on, stocks erased some of those losses leading into the ECB policy meeting – which turned out to be a non-event. Draghi, in the absence of German support, postponed any and all QE decisions into early next year. Then, at week’s end, the US jobs report released an eye-popping 321,000 non-farm payroll gain for the month of November. That piece of news helped stocks finish the week mixed, with the Dow up a little over half a percent and the NASDAQ down by roughly the same. Away from stocks, Treasuries foundered, probably due to record issuance. The dollar rose primarily against the yen as authorities in Japan eyed a 125.0 yen per dollar exchange rate as a near-term policy target. Despite the dollar’s spike, gold, silver, and the miners rallied and outperformed most assets for the week.

Based on that series of events, a few things came to mind worth mentioning. For starters, a lower gas price does not automatically equate to an increase in retail sales, as so many have surmised. While gas prices may be falling, consumers are faced with a series of cost offsets stemming from food, health care, and long-term interest rates – just to name a few. Also, let’s not forget that much lower gas prices than today’s did nothing to prevent previous bubbles from bursting (i.e., tech in 2000 and housing in 2008). As for the payroll report, I don’t think the markets took it seriously by day’s end on Friday. Most of the job gains were retail or temp in nature, and were posted in odd contrast to the 20,000 increase in jobless claims for the same month. Similar contrasts were seen elsewhere as new highs were seen in the major indexes throughout the course of the week while the broader indexes (the NYA), small caps, and High Yield Corporate Bond indexes have struggled to confirm, and are in fact still trending lower. High Yield (Ticker: HYG) in particular has been under pressure from the shale oil blow-up and retail, where sales forecasts have been slashed and majors like Sears are scuttling stores (235 at last count).

Whether the oil and retail issues now unfolding prove to be systemic or simply collateral to the overall financial system remains to be seen. I tend to believe that things are set to get worse rather than better (which could explain the solid price action in the metals this week). At $4.5 trillion in debt issuance by U.S. corporations over the last three years (which is 3x the borrowing prior to the dot-com bust), and with the U.S. national debt burden pushing $18.0 trillion – or 100% of U.S. (inflated) GDP (that’s roughly 80% growth in government debt to 40% growth in GDP since 2008) – an imminent inflection or breaking point would not be out of the question, QE or no QE. None of this has mattered to stock speculators thus far, who seem determined to finish the year on a high note. Their determination is impressive, but if the holiday season continues to be a flop, just about anything can happen between now and year end.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP