Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Take a Bow Despite the Fed

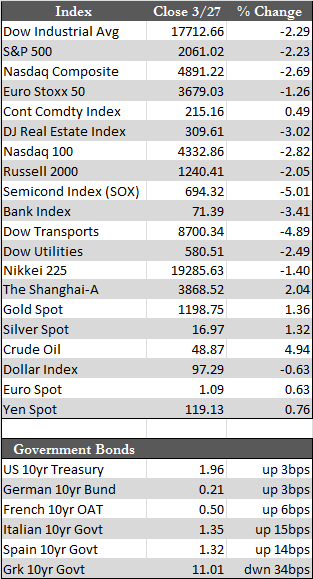

Stocks were lower this week, here and abroad, for very little reason that we could see. Other than the fact that profit taking is a decent call to make at these levels, there wasn’t much else getting in the way of a typical speculation-induced rally. That being the case, the action in stocks may not be a matter of discounting today’s news, but tomorrow’s. First quarter earnings are soon to be released, and if the behavior in stocks is any indication, results may be worse than expected. If so, they may trump all else – including the somewhat bullish delay in Fed policy normalization. The biggest drag on stocks this week came from the Tech sector, where, in addition to Intel’s news a few weeks back about lower PC demand, Taiwan Semiconductor last night warned that demand for its smartphone chips is also on the decline. Preannouncements like this will pick up in the first few weeks of April, while the earnings season will officially begin with Alcoa on April 8th. Till then, we would take any weakness in stocks as an indication that a cyclical downturn in earnings may in fact be underway.

Overseas, the ECB was active in its QE endeavors and in dealing with Greece. Very little progress is apparent on either front. After injecting €26.0 billion over 10 days into bond markets, bond yields of respective PIIGS nations (with the exception of Ireland) are now higher than when the ECB first launched the program March 9th. What that implies regarding QE’s effectiveness as an economic stimulant is thus far highly questionable, despite the ravings of Mr. Draghi to the contrary. We expect the bond markets of Germany, France, and the U.S. to react in similar fashion before long. Incidentally, U.S. bond markets were sluggish this week in the face of weaker equities. As interesting as that was, one week does not a trend make. However, it will be something to monitor.

Overseas, the ECB was active in its QE endeavors and in dealing with Greece. Very little progress is apparent on either front. After injecting €26.0 billion over 10 days into bond markets, bond yields of respective PIIGS nations (with the exception of Ireland) are now higher than when the ECB first launched the program March 9th. What that implies regarding QE’s effectiveness as an economic stimulant is thus far highly questionable, despite the ravings of Mr. Draghi to the contrary. We expect the bond markets of Germany, France, and the U.S. to react in similar fashion before long. Incidentally, U.S. bond markets were sluggish this week in the face of weaker equities. As interesting as that was, one week does not a trend make. However, it will be something to monitor.

Considering the above and a slightly weaker dollar on the week, the precious metals and oil witnessed steady price gains – handily outperforming the broader market. Oil may still be in a class of its own, subject to gross supply and demand imbalances. However, gold may see further upside, perhaps after a brief consolidation, if the U.S. economy continues to under-impress the Fed.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP