Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stock Prices Reflect “No Room For Error” as Earnings Season Approaches

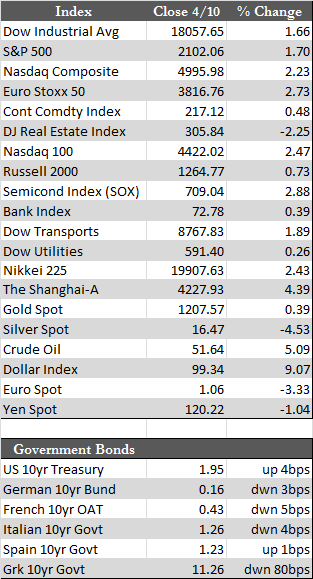

An underwhelming US jobs report released last Friday was not enough to prevent stock speculators from enjoying a pre-earnings season ramp-up. It ran for the entire week amid low volume. Granted, the report, which registered the creation of a paltry 126,000 jobs in March, may have renewed doubts as to the Fed’s interest rate-hiking resolve. More likely, stock bulls were busy extrapolating the benefits of QE from Europe, Japan, and perhaps China now – where the People’s Bank of China has indicated the need to counter a 37-consecutive-month (and counting) decline in inflation (or CPI) – along with record-pace mergers and acquisitions activity (over $1.0 trillion YTD). In response, stocks, most notably the small caps, were seen challenging old highs. Treasuries remained range-bound, while strength in the dollar index, now back near 100.0, attempted but failed to derail modest gains in gold.

Whether the markets will break through to new highs or not is of course unknown. The market can do whatever it wants for the moment. It enjoys scant news of significance, other than that QE is alive and well. However, as we go further into this earnings season, which will be in full swing next week, it may become more evident that QE in current quantities is doing very little to escalate economic activity beyond the vast leverage ($30.0 trillion-plus since 2008 worldwide, at the corporate and/or government levels) past efforts have accomplished. Therefore, it’s likely that stock markets are running on fumes or on the strength of the shorts, capitalizing on headline risk in what would otherwise be characterized as “mergers out of weakness.” As evidence of that assessment, we would include GE’s decision this week to exit its financial businesses and spend over 50% ($90.0 billion) of its cash on a share buyback program rather than on revenue-boosting projects.

Whether the markets will break through to new highs or not is of course unknown. The market can do whatever it wants for the moment. It enjoys scant news of significance, other than that QE is alive and well. However, as we go further into this earnings season, which will be in full swing next week, it may become more evident that QE in current quantities is doing very little to escalate economic activity beyond the vast leverage ($30.0 trillion-plus since 2008 worldwide, at the corporate and/or government levels) past efforts have accomplished. Therefore, it’s likely that stock markets are running on fumes or on the strength of the shorts, capitalizing on headline risk in what would otherwise be characterized as “mergers out of weakness.” As evidence of that assessment, we would include GE’s decision this week to exit its financial businesses and spend over 50% ($90.0 billion) of its cash on a share buyback program rather than on revenue-boosting projects.

Gold finished the week with a bit of upside momentum, though not in reaction to any apparent news. India’s gold imports reportedly doubled, though that was in comparison to a fairly small base last year when import restrictions were at a peak. Instead, it may be that the paper shorts in New York failed to break gold down (meaningfully) below the critical $1,200 mark, even as stocks and the dollar moved in their favor. Next week, we’ve got retail sales along with a host of earnings reports beginning Tuesday. Industrials and tech (semiconductors) have been forming a strong undertow within the markets as of late. Perhaps by next week we’ll see if the bulls wish to treat these areas as isolated incidents (i.e., Alcoa), or as risks systemic to the broader market.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP