Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Inflation Picks Up – but the Economy Doesn’t

The combination of dovish remarks made by ECB board member Benoit Coeure and another round of disappointing US (and Chinese) economic data helped to stabilize markets by renewing hopes for more QE. Coeure said that the ECB would be “front loading” its bond purchases next month. Even though he didn’t say that purchases would increase, European markets spiked higher on the presumption they would – at least initially. By week’s end, PIIGS debt was seen leaking again, probably as a result of failed talks with Greece in overnight markets Thursday.

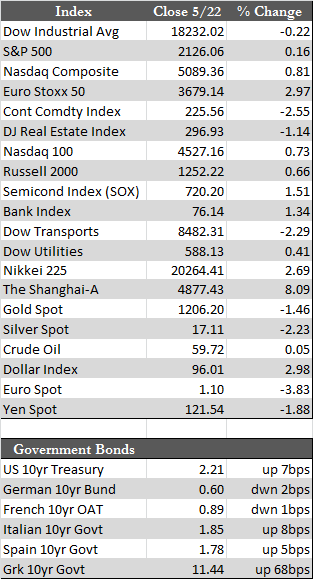

Here at home, a drop of 3.3% in existing home sales and a greater-than-expected uptick in April core CPI inflation of 0.3% put a wrench in Fed rate predictions. The S&P 500, Dow, and NASDAQ touched new highs, thereby bringing market momentum to a grinding halt in late Friday trade.

And in China, a lower-than-expected manufacturing PMI pushed stocks in Shanghai and Hong Kong to seven-year highs. Keep in mind that the worldwide action in stocks over the past few weeks amounts to a shift based on psychology, not actual QE, as central banks continue to operate under the impression that extant policies are working just fine.

And in China, a lower-than-expected manufacturing PMI pushed stocks in Shanghai and Hong Kong to seven-year highs. Keep in mind that the worldwide action in stocks over the past few weeks amounts to a shift based on psychology, not actual QE, as central banks continue to operate under the impression that extant policies are working just fine.

The thing to notice in all this is the policy-thwarting manner in which US and European core inflation gauges have been on the rise amid what can only be described as stagnant growth. It may not yet be overwhelming events, but if the dynamic continues it will strengthen the argument that central banks are trapped between the Scylla of printing to save debtors and the Charybdis of harming the economy through inflation. This may have been on the minds of traders when US stocks took a nosedive into the close Friday, though there is no telling about that. They may very well have been spooked by a “false breakout” scenario, given that stock market highs have not been confirmed by either breadth or the NYSE put/call ratio. In any case, it’s a possible development to keep an eye on as we go along.

While the precious metals and the miners consolidated in response to a firmer dollar/weaker euro this week, it was encouraging to see that momentum to the downside remained elusive – with solid support for gold above the $1,200 level. Stocks will need to roll over before a probable move to $1,250 or above can commence. So far, stock speculators have been able to ignore just about everything; lower earnings, the aforementioned market internals, and a fairly strong non-conformational move to the downside in the Dow Transports. That said, however, the market action at the close today implies those attitudes may finally be changing.

Stay tuned

Best Regards,

David Burgess

VP Investment Management

MWM LLLP