Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Ignore, Bonds Heed Central Banks

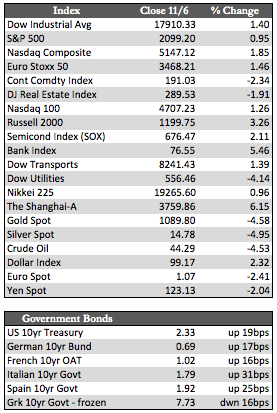

The major indexes here and abroad once again rallied into week’s end to finish with modest gains. However, the broader market (including small caps) refused to confirm by continuing to lag. Wall Street appears to be rotating away from marginal investments into those with premium names or not-so-questionable numbers in an attempt to capture some upside momentum and the benefits of an aesthetically pleasing portfolio. But longer term, or in the next few weeks, we’ll have to see if the trend can maintain itself or if the broader market will overwhelm to the downside. I will insist that the latter is more likely, but not too loudly. The market’s resilience has humbled many, including yours truly. But what seems obvious is that stocks will soon find themselves in a funding crisis, as happened a few months ago when the Fed was in rate-hike, not QE mode – as it is today.

Away from stocks, bonds were roughed up on a global basis, as many Fed, ECB, and BoJ officials leaned either less dovish or more hawkish in speaking engagements this week. I found Yellen’s remarks to the House Financial Services committee the most interesting because she seemed intent on bringing to light, perhaps in a deflective manner, the “major” compliance and risk management issues within the banking sector that could “hurt” the broader financial system if not addressed. Since most banks have passed their stress tests of late, it’s reasonable to assume that she was referring to the not-so-small $24 trillion (in debt) shadow banking sector, though that wasn’t clearly stated. However, Yellen may be cleverer than many suppose, introducing a timely scapegoat for the next impending crisis.

Away from stocks, bonds were roughed up on a global basis, as many Fed, ECB, and BoJ officials leaned either less dovish or more hawkish in speaking engagements this week. I found Yellen’s remarks to the House Financial Services committee the most interesting because she seemed intent on bringing to light, perhaps in a deflective manner, the “major” compliance and risk management issues within the banking sector that could “hurt” the broader financial system if not addressed. Since most banks have passed their stress tests of late, it’s reasonable to assume that she was referring to the not-so-small $24 trillion (in debt) shadow banking sector, though that wasn’t clearly stated. However, Yellen may be cleverer than many suppose, introducing a timely scapegoat for the next impending crisis.

With the dollar pressing upon its yearly highs, the precious metals were taken down without hesitation several sessions in a row, to within striking distance of their previous lows. Gold’s low sits at $1,072, which is not far from its current price. Ostensibly, it could breach that low rather easily. That said, however, it would take a flurry of “perfect” news to motivate the gold price meaningfully lower. With the dollar and long-term rates (among other issues) in no position to reverse the downward trend in earnings, it seems logical that the metals will begin to rebuild soon.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP