Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Equity Markets Soften Ahead of Earnings

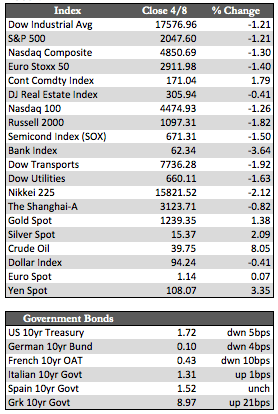

Equity markets both here and abroad were a touch weaker by a percent or two. I believe traders have begun to position themselves in front of what is likely to be a disappointing earnings season that will kick into high gear with the financials (banks) next week.

Beyond that, there’s not much to say about stocks. It was a dull, low-volume week. However, it was interesting to see stocks give up a portion of recent gains despite dovish remarks by central bank officials and the FOMC minutes released this week (Draghi cried “never surrender” in the battle against low inflation, while the Fed’s Dudley re-emphasized that the path of rate hikes should be “gradual”). I doubt the markets are ready to ignore the Fed and/or other central banks just yet, including the emergency Fed meeting set for Monday. However, it appears that the game playing in stocks has been suspended as we get closer to the real world of corporate results.

Away from stocks, the dollar was a smidge weaker, though mostly against the yen. The Japanese currency has been gapping higher, most likely due to carry trade unwinds.

Away from stocks, the dollar was a smidge weaker, though mostly against the yen. The Japanese currency has been gapping higher, most likely due to carry trade unwinds.

The defensive posture in stocks has perpetuated the slow and steady advance that we’ve come to see in Treasuries of late. The same can be said of higher quality European debt (e.g. German Bunds and British Gilts), though I think it’s worth mentioning that PIIGS debt has begun to underperform again. This could explain the ultra-easy (maybe panicked) talk by Draghi Thursday night.

Oil enjoyed a nice bounce back near 40, and the metals were higher. Gold was up 1.38% to silver’s 2.09%, while the miners jumped in excess of 6.0% on average – though it appears that short covering may have been responsible for at least half those gains.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP