Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

BoJ Sparks Reality Check

As the week began, stocks both here and abroad were moving sideways as investors prepared for a host of earnings reports and committee meeting outcomes from the Fed and the BoJ. On the whole, earnings results probably didn’t do much to sway stocks one way or another, as they were decidedly mixed. However, such results likely reflect more perception than reality. I believe the bottom line this quarter will prove to be much worse than the bulls expected. Heavyweights in tech (i.e., Apple), energy (Exxon, Chevron), and the financial sector (Goldman Sachs) have seen their earnings drop in excess of 15% – more than 50% in the case of Exxon and Chevron. But again, none of that seemed to matter much as the indices inched steadily higher into and after the Fed policy meeting on Wednesday. The bulls were emboldened once again by a slight change in language – this time having to do with the Fed’s eased concern over global risks (in other words, stocks have rallied back into the comfort zone).

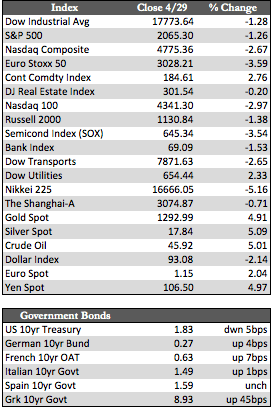

The party in stocks came to a rather abrupt end Wednesday night when the BoJ took away the punch bowl by concluding a rather hawkish vote against more QE. From that point on, it was all downhill for stocks until a last minute month-end run into the close on Friday. Treasuries were rather flat, but gained a little momentum on the upside as the week progressed – this due to the fact that quality debt overseas was marginally weaker even as stocks fell. As for the metals, they raced higher as the dollar tanked against the yen. Gold gained 4.9% to silver’s 5.08% and the miners’ 14%. At any other time in the recent past, the metals would have been crushed by bullish talk sans QE from central banks. That was obviously not the case this time around, and I believe a few overconfident short sellers in the metals learned a lesson the hard way this week.

The party in stocks came to a rather abrupt end Wednesday night when the BoJ took away the punch bowl by concluding a rather hawkish vote against more QE. From that point on, it was all downhill for stocks until a last minute month-end run into the close on Friday. Treasuries were rather flat, but gained a little momentum on the upside as the week progressed – this due to the fact that quality debt overseas was marginally weaker even as stocks fell. As for the metals, they raced higher as the dollar tanked against the yen. Gold gained 4.9% to silver’s 5.08% and the miners’ 14%. At any other time in the recent past, the metals would have been crushed by bullish talk sans QE from central banks. That was obviously not the case this time around, and I believe a few overconfident short sellers in the metals learned a lesson the hard way this week.

All that said, I suspect we are entering a new phase of central banking where foundering economies cannot be readily fixed by pushing the “Print” button. I believe this was the message behind the BoJ’s decision this week not to ease as a growing crowd of critics there begins to understand that QE and negative rates are causing more harm than good. I would also say that the same is true in Europe, where, despite the massive amounts of QE administered, inflation continues to come up short of expectations. I believe that when, not if, our markets begin to catch on to this revelation, it will translate into very meaningful and long-lasting changes to stocks, bonds, the dollar, and the metals. Next week should tell us if my analysis is on target, and, if so, whether that process is beginning.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP