Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Denial Still Reigns Supreme in the U.S.

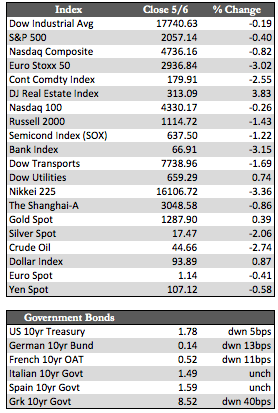

For the last several weeks I have thought that U.S. stocks were topping out rather than forming the new bull market that so many folks are expecting. So far, I have been wrong in that assumption. Stocks have maintained a fairly solid hold near their highs, even managing to creep higher when more dovish policy at the Fed (or any central bank) is expected after bad news. However, from what I observed in overseas markets this week, that trend may have seen its best days.

Most major equity markets overseas broke support to the downside despite a multitude of weak economic releases (including PMI data in Europe and manufacturing data in China). A chart may bring more clarity to this observance than the box scores will. The highs were set on Monday and not last Friday. For a better look at this development, I would encourage anyone with the charting means to take a quick look at the stock indices in China, Japan, and across Europe for a clearer view on the subject.

Again, weak economic or earnings data here in the U.S. has thus far been capable of producing a bullish expectation in the markets, as was the case following two fairly lackluster jobs reports this week. The ADP and the US non-farm payrolls on Friday both had jobs created at about 160,000 for April when 200,000 were expected. Earnings (even with the seasonal advantage) will come up shy of the 12.6% expected, with a little over 4.0% quarter-over-quarter growth instead.

Again, weak economic or earnings data here in the U.S. has thus far been capable of producing a bullish expectation in the markets, as was the case following two fairly lackluster jobs reports this week. The ADP and the US non-farm payrolls on Friday both had jobs created at about 160,000 for April when 200,000 were expected. Earnings (even with the seasonal advantage) will come up shy of the 12.6% expected, with a little over 4.0% quarter-over-quarter growth instead.

In any case, the rallies that come after such dismal results seem to be gradually losing steam – the indices have yet to break through their highs set in mid-April. This doesn’t mean that they won’t make another run for their highs again in the next handful of weeks as the “no earnings news” period approaches. However, I suspect that with the dismal action overseas and another dip in earnings likely on the way next quarter, we could see stocks here in the U.S. start to close the gap with their foreign counterparts (the DAX is off 18% from its highs vs. the Dow’s 3.3%).

Away from stocks, Treasuries were flat and the dollar was a bit firmer, mostly against the euro, but this didn’t stop the metals and the miners from finishing on a high note later in the week. Of course the jobs numbers helped, but I also believe inflation is becoming more problematic than stock bulls are aware. The ISM Prices Paid index jumped from 51.5 to 59.0 in April. These things, including the overdue thrashing stocks should soon get, may see gold break out above the 1,300 level on its way through 1,350 before we witness another consolidative phase.

Best Regards,

David Burgess

VP Investment Management

MWM LLC