Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Can’t We Just Ignore Everything for Just One More Quarter?

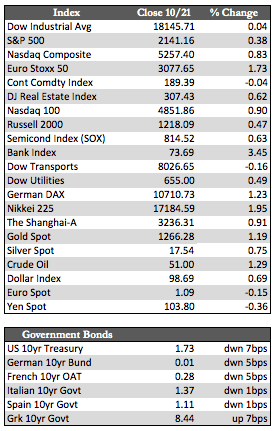

With third-quarter earnings season in full swing, US stocks had trouble gaining any momentum to the upside this week. Results so far have been mixed at best. On the positive side, the financial sector seems to have hit the cover off the ball this quarter. Interest rates fell substantially this year, and lending (+11%) and fixed income trading (+40) saw double digit growth at most of the major banks. The same growth in fixed income trading is evident at Goldman Sachs and Morgan Stanley, but the sustainability of such growth has been called into question by both firms laying off large portions of their fixed income trading desks – 10% for Goldman and 25% for Morgan Stanley. Away from the financials, the winners circle shrinks fast – though Netflix shares gained 27% after announcement of “better than expected” in almost every category, and Microsoft shares gained 4.56% (so far) on better sales and profits from advancements in cloud computing.

More typically, Verizon Communications reported the worst subscriber growth in six years, Intel and GE both said they would have trouble meeting their fourth-quarter expectations, hedge fund profits (at Blackrock) remain in question after some of the worst outflows for the industry since second quarter 2009, and Travelers Companies had its fourth consecutive decline in profits due to lower investment income (not just hurricane expenses). None of that seems to matter much to stock speculators in the wake of still-strong corporate buybacks (the folks buying this market on every dip) and a trigger-happy Fed ready to intervene.

There are now seven stocks trading near all-time highs that seem to be supporting the Dow – which has been teetering on its 100-day moving average for over a month now. They are Merck, JP Morgan, Proctor and Gamble, Visa, Cisco, Intel, and Microsoft, with only Visa and Microsoft showing any real interim strength on the charts. Away from stocks, Treasuries and fixed income crept higher worldwide after Draghi made it clear that the ECB was not considering a taper to its current QE program. Instead, the ECB plans to extend and perhaps add to its current bond-buying program as early as March next year. In that environment, the dollar spiked higher against most currencies. It now trades comfortably in bullish territory (at 98.67), near its highs for the year, but this has yet to throw the metals off course as gold added 1.19% to silver’s 0.52% for the week.

Best Regards,

David Burgess

VP Investment Management

MWM LLC