Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Shift in Sentiment?

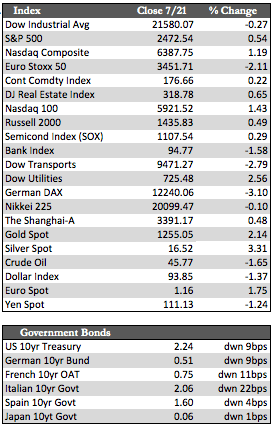

Most stock indices around the globe were modestly lower during the week, with the exception of those in the Greater China area (aided by a falling US dollar) and the NASDAQ, which gained on the pre-earnings hype surrounding the FANGs. Besides Netflix, which is the only member of the FANG group to report thus far, earnings on the whole have yet to impress. In particular, GE, a bellwether by most standards, saw its sales and earnings decline along with its shares on Friday (-2.92%). The company said its issues were related to oil investments, but I believe it was the general lack of profits across all fronts that concerned investors. In any case, stock bulls are having to digest quite a bit lately, and not all of it good. Notwithstanding the malaise of overseas issues, Trump policy setbacks (the GOP mothballed healthcare reform this week) are, I believe, starting to affect the overall psychology of the market. That psychology, aided by leverage, has been the principal driver behind the market’s recent advance despite underlying weaknesses. This is illustrated by the fact that second-quarter earnings are still expected to be about 1% lower than where they were at the peak in 2014, yet stocks from that time forward have marched 25.0% higher (most of which were post-election gains). If the bulls start catching on to the fact that Trump truly can’t solve all our financial problems, a very large reversal in stocks may be forthcoming, quite possibly before year-end.

Away from equities, the dollar was seen extending its freefall. It is now off 8.2% since the beginning of the year. This helped the metals out of the doldrums and into a fairly healthy jump on the week, as gold added 2.14% to silver’s 3.29%. Of course, Yellen’s crossover to dovish remarks on Monday had a share in the momentum, but I do believe the reasons for the dollar’s movements go well beyond the Fed. Aside from this, oil lost a smidge and is still in a technical downtrend for the year, while Treasuries gained along with most quality government debt overseas, mostly on a rotation away from the foundering action in stocks. On the economic front, US housing starts and permits in June were up 8.3% and 7.4% respectively. It’s possible that this was due to the now well-known and misguided hype that banks were going to make more money on loans because of the higher rates or not. We’ll just have to wait and see what happens next month to be sure.

Away from equities, the dollar was seen extending its freefall. It is now off 8.2% since the beginning of the year. This helped the metals out of the doldrums and into a fairly healthy jump on the week, as gold added 2.14% to silver’s 3.29%. Of course, Yellen’s crossover to dovish remarks on Monday had a share in the momentum, but I do believe the reasons for the dollar’s movements go well beyond the Fed. Aside from this, oil lost a smidge and is still in a technical downtrend for the year, while Treasuries gained along with most quality government debt overseas, mostly on a rotation away from the foundering action in stocks. On the economic front, US housing starts and permits in June were up 8.3% and 7.4% respectively. It’s possible that this was due to the now well-known and misguided hype that banks were going to make more money on loans because of the higher rates or not. We’ll just have to wait and see what happens next month to be sure.

Best Regards,

David Burgess

VP Investment Management

MWM LLC