Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Hurricanes are Still Bullish – Apparently

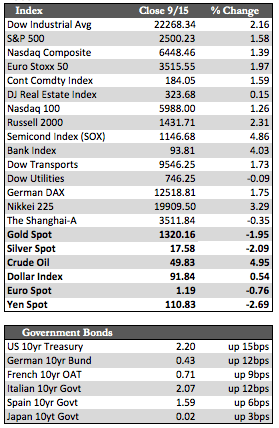

As hurricane Irma passed through Florida causing less-than-expected damage, stocks saw fit to start the week off with a strong rally. They were abetted by short-covering that lasted virtually the entire week. The Dow, the S&P 500, and the NASDAQ set new all-time highs by Wednesday, at which time the rally wobbled a bit in light of an Apple product launch that most traders found lacking. Apple’s books are besotted with excess amounts of aged inventories, while the absence of marginal utility is preventing the average customer upgrade. In any case, stocks finished the week on a relatively high note as the storm-rebuild story prevailed. Other factors were at work, as well, including promissory talk from Washington about tax cuts and healthcare reform, and building sentiment that the Fed will be less hawkish come Sept 20th in the aftermath of the recent storms. Technically speaking, volumes were average, the FANGs lagged, the Dow outpaced the major indices, and the Semiconductor index posted the best sector gains of the week.

As to the economic data, it was rather distorted and might remain so for the next few months thanks to the hurricanes. In the month of August, retail sales fell -0.2%, auto sales were down 1.6%, industrial production slipped 0.9%, and the inflation data was mixed, with the PPI lower than expected at 0.2% and the CPI higher than expected at 0.4%. MBA mortgage apps spiked 9.9% through week ending Sept 8th. Aside from stocks and the data, Treasuries, EGBs, and JGBs were heavier, oil rallied nicely (perhaps storm-related), gasoline reverted to pre-storm levels, and the dollar managed a small gain. However, that small gain was enough to set the metals on a corrective path, as both gold and silver gave up 1.8% of their recent gains. Gold is rumored to have found support at the $1,321 level, though I believe a test of $1,310 will prove to be more significant.

As to the economic data, it was rather distorted and might remain so for the next few months thanks to the hurricanes. In the month of August, retail sales fell -0.2%, auto sales were down 1.6%, industrial production slipped 0.9%, and the inflation data was mixed, with the PPI lower than expected at 0.2% and the CPI higher than expected at 0.4%. MBA mortgage apps spiked 9.9% through week ending Sept 8th. Aside from stocks and the data, Treasuries, EGBs, and JGBs were heavier, oil rallied nicely (perhaps storm-related), gasoline reverted to pre-storm levels, and the dollar managed a small gain. However, that small gain was enough to set the metals on a corrective path, as both gold and silver gave up 1.8% of their recent gains. Gold is rumored to have found support at the $1,321 level, though I believe a test of $1,310 will prove to be more significant.

Whether stocks can rally further from here is, I believe, a matter of debate. Year-end dynamics (think window dressing) that will use the storm rebuild as a launchpad will be pitted against a broader deterioration in the financial underpinnings of this market. Along those lines, both JPM and Citigroup announced that trading revenue will be 10 to 15% lower in the third quarter. I mention this only because, generally, as go the banks, so goes the market. Next week, we have the Fed and maybe a few more “off the cuff” remarks by Janet Yellen before her retirement in February next year.

Best Regards,

David Burgess

VP Investment Management

MWM LLC