Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

What Tax Reform Giveth, Tax Reform Taketh Away?

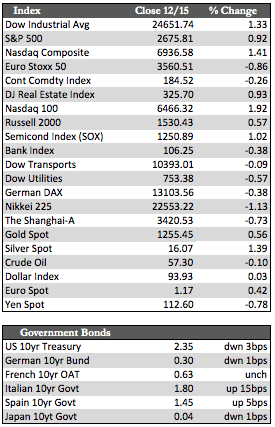

As soon as Trump was expected to sign the Republican Tax Bill into law, the markets leveled out, taking back a few points from their earlier gains. Most of the major averages retained about 0.25% to close out the week. This excluded the Dow Transports, which tacked on another 2.39% to set a new high. There was no apparent reason for the Transports to spike other than that investors were responding to tax code changes or perhaps latent storm related activity (in trucking).

Trump managed to approve the GOP tax bill late in the afternoon Friday, but questions still remain as to whether or not the code will amount to an actual tax cut for the middle class. To be sure, tax brackets and the percentages folks pay have changed for the better, but the removal and/or capping of certain deductions (e.g., interest paid, medical) allowed has everyone wondering what the net results will be. The corporate tax bracket will be reduced from 35.0% to 21.0%, and will act more like a flat tax as the loopholes (to avoid taxes) with be greatly reduced. Many larger corporations will be faced with significant “one-time” charges (against cash overseas and/or deferred tax assets) before being able to participate in the new plan. Like individuals, corporations will be disadvantaged in the way interest paid on debt can be deducted. This has led many to believe that corporations will default to foreign sources of financing and that real estate values will soften (at the higher-end) here at home.

Trump managed to approve the GOP tax bill late in the afternoon Friday, but questions still remain as to whether or not the code will amount to an actual tax cut for the middle class. To be sure, tax brackets and the percentages folks pay have changed for the better, but the removal and/or capping of certain deductions (e.g., interest paid, medical) allowed has everyone wondering what the net results will be. The corporate tax bracket will be reduced from 35.0% to 21.0%, and will act more like a flat tax as the loopholes (to avoid taxes) with be greatly reduced. Many larger corporations will be faced with significant “one-time” charges (against cash overseas and/or deferred tax assets) before being able to participate in the new plan. Like individuals, corporations will be disadvantaged in the way interest paid on debt can be deducted. This has led many to believe that corporations will default to foreign sources of financing and that real estate values will soften (at the higher-end) here at home.

To sum all this up, I remain skeptical as to the overall effects the tax bill will have on the economy. Suffice it to say, I do not believe 4% economic growth and another stellar run for stocks occupies our immediate future. Much-anticipated spending increases have already been muted in real terms thanks to the inflation caused by Wall Street’s frenzied speculation so far this year. And the dollar remains in the same uncompetitive place as it has for the past several decades – which should still perpetuate the long-standing shift of investment and/or job creation overseas. In any case, the markets have already shown signs of cooling as money has begun to seek relative safe havens in such areas as consumer staples, bonds, and the metals as we close out the year. A trend, of course, that I believe is going to gain momentum as we progress into the next.

This will be the last recap until January 5th. Until then, Merry Christmas and Happy Holidays to you all!

Best Regards,

David Burgess

VP Investment Management

MWM LLC