Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Market Setting Rates – Not the Fed?

After a rally attempt early in the week, stocks came under considerable pressure – so much so that the Dow tested its 100-day moving average and the lows set in February. First we had Powell’s somewhat hawkish testimony, which he tried to counter with economic “optimism.” Then came Trump’s tariff proposal, which among other things is intended to protect both the steel and aluminum industries. Both were viewed as a negative for stocks. One implies higher rates (i.e., costs) and the other a “trade war.”

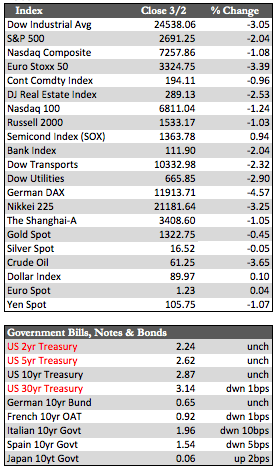

I believe the Fed is behind the curve, chasing rates that are being driven higher by natural market forces. While tariffs may not be the best answer to extant competitive imbalances, they surely aren’t the worst idea. They are certainly not undeserved, given that some of our foreign counterparts have successfully manipulated exchange rates to gain an export advantage over the U.S. for several decades. In any case, the negativity triggered by these events was once again cut short (when compared to overseas markets) by the usual Friday rally. Stocks were held to losses of about 1% for the NASDAQ and over 2% for the Dow and S&P.

I believe the Fed is behind the curve, chasing rates that are being driven higher by natural market forces. While tariffs may not be the best answer to extant competitive imbalances, they surely aren’t the worst idea. They are certainly not undeserved, given that some of our foreign counterparts have successfully manipulated exchange rates to gain an export advantage over the U.S. for several decades. In any case, the negativity triggered by these events was once again cut short (when compared to overseas markets) by the usual Friday rally. Stocks were held to losses of about 1% for the NASDAQ and over 2% for the Dow and S&P.

When it comes to bonds, rates still seem bent on creeping higher whether stocks rise or fall. This tendency might not have been apparent this week, but I thought it was remarkable that, despite the weakness in stocks, rates remained relatively unchanged. As I have said before, the bond market seems to be slowly developing a life of its own rather than taking dictation from the Fed, stocks, or perhaps in some cases the economy. If so, this development could indicate a crisis in the making that would be very bullish for the metals. I don’t want to jump too far in that direction just yet – even if it is a development long overdue. Still, you can check my math by taking a look at the box scores. Despite the weakness in stocks, rates crept higher at the long-end while short-term rates were relatively unchanged.

Aside from this potentially portentous news, Wards domestic Vehicle Sales dropped for a third month in January – this time by 1.2%. And MBA mortgage applications bounced 2.7% in the latest week (after last week’s 6.6% decline). Dollar, crude oil, and gold trades all seem range-bound around their respective 89.0, 61.0/bbl, and 1,330 levels pending further information on inflation.

Next week, oil industry leaders will gather in Houston, the European Central Bank will make a decision on interest rates (and/or QE tapering), and the U.S. jobs report for February will be released. I suspect that, alongside the weakness we’ve seen in housing and autos of late, jobs may be a bit shaky, too. If that’s the case, it will be interesting to see whether or not the Fed can repair to its longstanding but highly questionable (given bond/rate behavior) characterization that economic soft spots are “transitory.”

Best Regards,

David Burgess

VP Investment Management

MWM LLC