Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

No New Changes

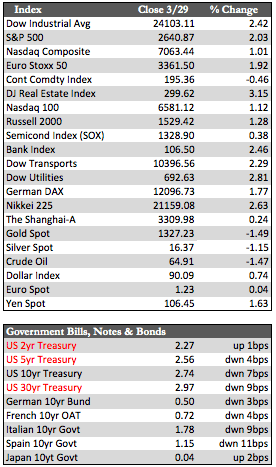

After last weeks’ drubbing, equity markets enjoyed a decent bounce that added a little over 2% to the Dow and S&P by today’s close. In my opinion, those moves, though largely technical (testing the February lows), found some legs after China’s hollow-sounding threats in reaction to Trump’s $60 billion worth of tariffs, and of course Trump’s extradition of Russian diplomats. The NASDAQ’s rally was far more subdued given some heavy selling among the FANGs as a breach in privacy at Facebook and Amazon’s tax-free status became the topics du jour. Further, despite all the sound and fury, the charts still suggest that stocks are in bearish territory. They have yet to re-enter a two-month-old pennant formation they dropped out of last Thursday.

The post-storm economic data released this (abbreviated) week was rather sparse. Suffice it to say, we are still in the process of downshifting from that eventful fourth quarter of last year. Case in point: pending home sales rose 3.1% in February, but this was after a more robust 5.0% decline in January. Aside from this, Treasuries (and global fixed income) continued to benefit from the defensive market undertones, mostly at the long end, as the 10-year yield fell 7 bps to 2.74%. However, the 2-year bucked that trend, adding a few basis points to yield 2.27% in a further flattening of the yield curve. The dollar, though range-bound, managed a small gain. That move contributed to mild setbacks in both the metals and oil. Next week, we’ll see if stocks can regain their technical footing, and on Friday we’ll get another look at US jobs.

The post-storm economic data released this (abbreviated) week was rather sparse. Suffice it to say, we are still in the process of downshifting from that eventful fourth quarter of last year. Case in point: pending home sales rose 3.1% in February, but this was after a more robust 5.0% decline in January. Aside from this, Treasuries (and global fixed income) continued to benefit from the defensive market undertones, mostly at the long end, as the 10-year yield fell 7 bps to 2.74%. However, the 2-year bucked that trend, adding a few basis points to yield 2.27% in a further flattening of the yield curve. The dollar, though range-bound, managed a small gain. That move contributed to mild setbacks in both the metals and oil. Next week, we’ll see if stocks can regain their technical footing, and on Friday we’ll get another look at US jobs.

Have a wonderful Easter weekend.

Best Regards,

David Burgess

VP Investment Management

MWM LLC