Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed Bows to the Pressure

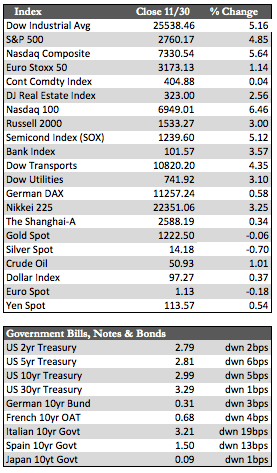

It shouldn’t come as a surprise to those paying attention to this year’s economic events, but I think it’s safe to say that the Fed has officially turned the corner on policy. Following several Fed speakers, including Chairman Powell, and the release of the FOMC minutes on Thursday, the Fed has made it clear that it is one hike away from “neutral” (i.e., 2.5% Fed Funds) and will not be raising rates in 2019 – when three raises were planned. Of course, the market reaction was somewhat predictable as well. Stocks made some quick gains, led by the NASDAQ, which added about 5.5% on the week. Treasuries rallied as well, though I think it’s interesting that the market has a completely different idea of what neutral means.

This was most evident in the 2-year Treasury, where the yield held to a tight range around the 2.80% level – 30bps above the Fed’s intended target. Anyway, it was a week filled with a series of very powerful knee-jerk reactions that, in the end, didn’t amount to very much from a technical perspective. But that can also change now that stocks have earned mid-single digit returns for the year. Fund managers may be eager to “window dress,” or add to positions before year-end reporting.

This was most evident in the 2-year Treasury, where the yield held to a tight range around the 2.80% level – 30bps above the Fed’s intended target. Anyway, it was a week filled with a series of very powerful knee-jerk reactions that, in the end, didn’t amount to very much from a technical perspective. But that can also change now that stocks have earned mid-single digit returns for the year. Fund managers may be eager to “window dress,” or add to positions before year-end reporting.

With the G20 meetings in view, the dollar managed to skate past the Fed and post a small gain on the week. Trade will be one of the hot topics among officials in meetings that end Saturday. If things go well, Trump may avoid the need to apply $250 billion in new tariffs on Chinese imports. As such, the dollar may fall and the metals mayrally – which would be welcome relief to metals investors. But whatever the case, the longer-term driver of the metals will likely be interest rates – which will be a frequent topic in future recaps. Next week, Trump will meet with Chinese President Xi (after the G20) on trade, and we’ll get another look at ISM manufacturing and jobs for the month of November.

Best Regards,

David Burgess

VP Investment Management

MWM LLC