Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Volatile Beginnings

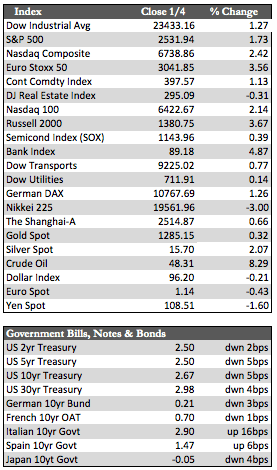

The first week of the New Year was a volatile yet profitable one for stocks. By the close on Friday stocks managed to finish with a small gain, led by bank and small-cap shares. Fueling the rally were rekindled hopes of a China trade deal, better than expected ADP/NFP job reports, and economic cheerleading from J. Powell and L. Kudlow. Together, these trumped a recessionary ISM manufacturing report from China (December 49.4), a larger-than-expected first-quarter profit warning from Apple, and the ongoing US government shutdown debate. All told, it was a week defined by a great deal of motion and commotion that amounted to nothing more than New Year’s posturing – perhaps exacerbated by the fact that the stock market may have entered 2019 in a temporarily oversold position. Despite the many resolutions to the contrary, 2019 will soon begin to look like 2018, I suspect, as both the equity and bond markets will face the same critical credit/funding issues.

Away from stocks, Treasuries maintained a defensive posture for most of the week (ex Friday trade), rallying even on days when stocks advanced. I suspect this was because the bond market sees a recession ahead or because of the Fed’s increasingly dovish remarks – or both. The dollar finished an otherwise bullish week with a fractional loss after the Yen jumped 4% against the Aussie dollar and Turkish lira in overnight trading Wednesday. The metals eked out a small gain despite some technically related selling around the $1,300/oz. level for gold. And oil spiked higher ahead of the next round of predetermined OPEC production cuts. Next week, we’ll get the FOMC minutes on Wednesday, and another look at the ever-expanding US Federal budget deficit on Friday.

Away from stocks, Treasuries maintained a defensive posture for most of the week (ex Friday trade), rallying even on days when stocks advanced. I suspect this was because the bond market sees a recession ahead or because of the Fed’s increasingly dovish remarks – or both. The dollar finished an otherwise bullish week with a fractional loss after the Yen jumped 4% against the Aussie dollar and Turkish lira in overnight trading Wednesday. The metals eked out a small gain despite some technically related selling around the $1,300/oz. level for gold. And oil spiked higher ahead of the next round of predetermined OPEC production cuts. Next week, we’ll get the FOMC minutes on Wednesday, and another look at the ever-expanding US Federal budget deficit on Friday.

Best Regards,

David Burgess

VP Investment Management

MWM LLC