Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Markets Wait for Details

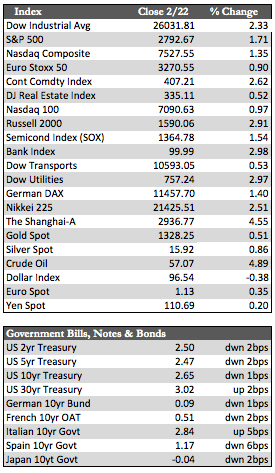

In terms of market action this week, there was a fair amount of directionless volatility amid a myriad of headlines driven by hopes for a trade deal with China, the Dow, S&P, and NASDAQ all managed to add about 0.5% and treasuries remained virtually unchanged across the curve. So far, only an agreement regarding the treatment of currency has been reached with China, but Trump officials say a broader trade deal covering agriculture and trade secrets (among other things) will be seen as early as next month. Given the fact that the markets hardly budged on the currency news, stocks may not react bullishly to anything short of perfection – whether that’s a trade deal, Fed policy, or the economy, for that matter. Stocks have retraced to extremes similar to those seen in September of last year. Term premiums remain at record lows, while interest rates remain restrictively high for the purpose of inducing any kind of meaningful “growth”- a problem the Fed, caught in a liquidity trap, may be helpless to change.

The economic releases this week were once again ignored by the market, which I don’t really find that surprising. Most of the information was influenced by the government shutdown. We may not get any real data capable of moving markets until mid-March – all things remaining equal away from the trade deal. Aside from this, I thought the FOMC minutes released on Wednesday were rather duplicitous, to say the least. They called for slower growth and a second half recovery in 2019. The latter of course would require further rate hikes. All this comes after the Fed gave a non conclusive “wait and see” message due to low visibility just one short month ago. Anyway, that slight comment sent the dollar a bit higher and commodities a bit lower. The metals in particular fell from interim highs set earlier in the week, though gold held on to a small gain of 0.84% to silver’s 1.06%. Gold actually hit $1,347 much sooner than I expected. To get past $1,350 with some degree of determination, however, it may require greater clarity from the data – as mentioned before.

The economic releases this week were once again ignored by the market, which I don’t really find that surprising. Most of the information was influenced by the government shutdown. We may not get any real data capable of moving markets until mid-March – all things remaining equal away from the trade deal. Aside from this, I thought the FOMC minutes released on Wednesday were rather duplicitous, to say the least. They called for slower growth and a second half recovery in 2019. The latter of course would require further rate hikes. All this comes after the Fed gave a non conclusive “wait and see” message due to low visibility just one short month ago. Anyway, that slight comment sent the dollar a bit higher and commodities a bit lower. The metals in particular fell from interim highs set earlier in the week, though gold held on to a small gain of 0.84% to silver’s 1.06%. Gold actually hit $1,347 much sooner than I expected. To get past $1,350 with some degree of determination, however, it may require greater clarity from the data – as mentioned before.

Best Regards,

David Burgess

VP Investment Management

MWM LLC