Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bear Market Rally?

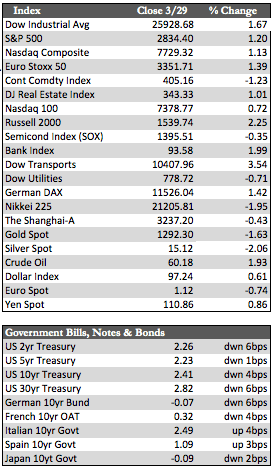

Stocks recuperated from last week’s losses with a gainful bounce as the indices, led by the Dow transports, added between 0.60% and 3.5%. Renewed hope in a US-China trade deal, a second-half rebound, and a contingent of Fed-model relative value shoppers formed the impetus for the advance. Quarter- and month-end window dressing may also have had a positive yet artificial impact on prices. That being the case, however, any real upside momentum in stocks may be difficult to generate past the 1stof April. A sizable portion of the rotational money that vacated stocks under topping out conditions has given a decidedly bearish indication by remaining in bonds. Whatever upside activity we see in stocks from here out is likely to be had within the context of a bear market rally. The smart money has chosen to wait out the financial and economic bumps in bonds until there are signs the cycle is complete. Of course, all of that assumes we’re in a bear market to begin with, and funds stick to the bond market as they have thus far.

Away from stocks, Treasuries rose across the curve as the 2- and 10-year yields settled near 2.26% and 2.40% respectively. Sovereign debt in Europe and Asia saw similar gains, especially in Germany where yields have gone negative out to 10 years. However, currencies in these regions fell against the US dollar on Brexit issues and perceived US strength, economically and relatively speaking. The dollar is now near interim all-time highs and has threatened, albeit temporarily in my opinion, the advance of the metals. Gold lost 1.5% to silver’s 2.0%. Aside from this, oil rose above $60/bbl after a fresh round of OPEC production cuts.

Away from stocks, Treasuries rose across the curve as the 2- and 10-year yields settled near 2.26% and 2.40% respectively. Sovereign debt in Europe and Asia saw similar gains, especially in Germany where yields have gone negative out to 10 years. However, currencies in these regions fell against the US dollar on Brexit issues and perceived US strength, economically and relatively speaking. The dollar is now near interim all-time highs and has threatened, albeit temporarily in my opinion, the advance of the metals. Gold lost 1.5% to silver’s 2.0%. Aside from this, oil rose above $60/bbl after a fresh round of OPEC production cuts.

I haven’t mentioned the economic data here because it is sure to reflect the wild ride now ongoing in the bond market – which really accelerated around March 18th. Marginally lower rates have already produced an uptick in housing, as mortgage applications rose 8.9% the week ending March 22nd. Consequently, the data for April and the subsequent reaction in stocks will be more relevant to consider as we move forward. Next week, we may see a Brexit and US/China trade deal (though I am doubtful), and some economic insight from the ECB minutes.

Best Regards,

David Burgess

VP Investment Management

MWM LLC