Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

This Just In: We Have a Deficit

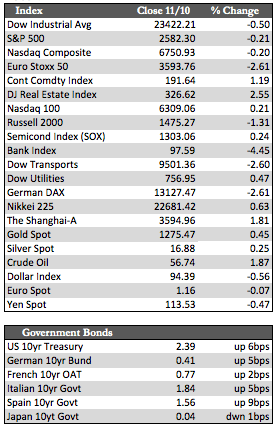

Markets shuttered on Thursday after the Senate’s version of tax reform was released. The plan reinstated a few of the more popular tax breaks, including ones for mortgage interest and medical expenses (that the House omitted in its first run), which was probably expected. But the real zinger occurred when it was announced that Senate GOP leaders were not interested in passing corporate tax reform, subsequently delaying such legislation until 2019, over deficit concerns. House leaders apparently felt the same, as the idea found some support from House Speaker Paul Ryan. That news caused a little downside momentum to develop past Thursday such that the major stock indices gave up on earlier gains to finish slightly in the red. In any case, I really think it’s a tossup when it comes to predicting year-end performance, i.e., whether or not disappointments like this have any legs. Most bad news up to now has been bought by dip buyers, year-end gamers, and the like. Case in point, Nvidia and Priceline both declined after their earnings reports, only to be accumulated aggressively thereafter. Still, I still get the impression that the weaknesses inherent in earnings, the overall economy, and the shortcomings in Washington are becoming too much for even the most aggressive speculators to bear. If we don’t get a dislocation in the markets before year-end, we will probably see some fireworks to start 2018.

Away from stocks, long-term sovereign debt yields were seen moving up across the globe – surprisingly in tandem with the rollover in stocks (beyond Thursday). High-Yield corporate debt is off by about 2.09% from its mid-year high, and its decline is raising some eyebrows over mid- or lower-tier (junk) corporate profits, as earnings reports have failed to impress at these levels. Goldman Sachs apparently issued a “trim” order on High Yield, citing an “aged” business cycle. Crude Oil had another decent week on increased political risk in Saudi Arabia. The dollar lost some ground in sympathy with stocks over tax issues, which helped the metals hold on to modest gains despite a mysterious four-million-ounce block sell order that hit gold for about 10 points Friday morning.

Away from stocks, long-term sovereign debt yields were seen moving up across the globe – surprisingly in tandem with the rollover in stocks (beyond Thursday). High-Yield corporate debt is off by about 2.09% from its mid-year high, and its decline is raising some eyebrows over mid- or lower-tier (junk) corporate profits, as earnings reports have failed to impress at these levels. Goldman Sachs apparently issued a “trim” order on High Yield, citing an “aged” business cycle. Crude Oil had another decent week on increased political risk in Saudi Arabia. The dollar lost some ground in sympathy with stocks over tax issues, which helped the metals hold on to modest gains despite a mysterious four-million-ounce block sell order that hit gold for about 10 points Friday morning.

Next week, the House will put its version of the tax bill to a full vote, several Fed governors will speak, and the majority of US third-quarter corporate earnings will come to a close. Earnings thus far, on a reported (not operating) basis, will exceed the high set in the fourth quarter of 2014 by about 3.3% – aided, in my opinion, by share-buybacks and storm-related spending, which have effectively masked otherwise low-quality (accounting related) results.

Best Regards,

David Burgess

VP Investment Management

MWM LLC