Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Defensive Tone to Start 2015

Before diving into events of the week, it may be worth reprising a few items of note from the last days of 2014. US third-quarter GDP reportedly grew by 5.0% (4.3% was expected). The surprise was due in large part to a 9.9% increase in government expenditures (in defense and healthcare) and a 3.2% increase in consumer spending – thanks to cheaper gas. But as we approached year-end, the consumer landscape may have changed a bit as holiday sales struggled in terms of top-line sales and/or profits on aggressive discounts. Sales in December looked almost identical to those from Black Friday. On key dates, retail sales fell by 1.7% overall, with online sales improving – though not enough to offset an 8.0% decline at brick and mortar stores.

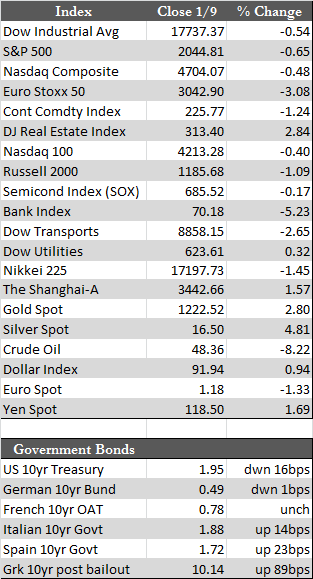

As usual, stock speculators were unfazed by any and all news as efforts to game stocks higher into year-end took precedence. That said, however, it was interesting to see that even while the major indexes (Dow & S&P) managed to finish the year at new highs, the broader index (i.e., The NYSE Composite Index) has been struggling to confirm the setting of what appears to be a series of lower highs. It may be something or it may be nothing, but there seems to be some caution in the wind as we head into 2015. Year to date, stocks have underperformed – by a wide margin – defensive counterparts such as Treasuries and the precious metals.

As usual, stock speculators were unfazed by any and all news as efforts to game stocks higher into year-end took precedence. That said, however, it was interesting to see that even while the major indexes (Dow & S&P) managed to finish the year at new highs, the broader index (i.e., The NYSE Composite Index) has been struggling to confirm the setting of what appears to be a series of lower highs. It may be something or it may be nothing, but there seems to be some caution in the wind as we head into 2015. Year to date, stocks have underperformed – by a wide margin – defensive counterparts such as Treasuries and the precious metals.

As ultra-levered as these markets are, it may be no secret among large institutions and the central banks that deleveraging poses would could be an uncontrollable risk. This is evidenced by the fact that each and every sell-off in equities so far has been radically reversed by talk of QE or actual QE. Consider as an example the ECB’s presentation to policymakers this week of a model to buy as much as €500.0 billion in investment-grade bonds – this immediately following a sharp decline in broader European equities at the start of this year.

It won’t be too long until the Fed starts playing the same games. It has already started to balk on interest rate hikes – for what could be any number of valid reasons, but most notable might be the burgeoning credit risk emanating from the energy sector. There, some $250 billion is theoretically in default at present, with another $800 billion at risk longer-term if oil prices cannot rebound above $70.

In any case, Fed complacency with respect to QE (so far) has put the dollar into overdrive against a collapsing euro – but that will eventually change. The dollar index is now trading in no man’s land above its long-term technical resistance level of 89.74. That doesn’t necessarily mean that a reversal to the dollar’s ascent is in the cards anytime soon, but it has at least prompted a shift in sentiment within adjacent markets – notably that of the metals. Gold rose over 2.8% and silver 4.81% this week despite the dollar, and may finally be in the process of detaching themselves from all currencies. Time will tell.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP