Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Germany Thrives Again on the Imbalances

It should be no surprise that the Greeks were able to extend and increase their credit line without having to promise much in the way of fiscal austerity. That combined with the ECB’s QE program has helped revive most European equity, and to a lesser degree respective bond markets (though Greek bank stocks turned south in a hurry by mid-week). That said, so far Germany has been the only nation in the Eurozone to post meaningfully better results, economically speaking, in the wake of it all. German exports and construction spending have been on the rise, due in large part to a weaker euro, while its import prices have fallen thanks to cheaper oil. German stocks as measured by the DAX now sit at an all-time high, and have incidentally “caught up” to U.S. stocks in terms of performance since the crisis times of ’08. In any case, I stress the fact that thus far Germany seems to be the only nation capable of creating surpluses on the back of the weaker euro. Others reap small benefits while continuing to operate under the burden of weighty deficits.

As we have mentioned many times, QE is losing its ability to stimulate economic growth worldwide. File it under the law of diminishing returns if you will. Sweden announced this week that it saw almost no result from its first foray into quantitative easing, where the yield on its five-year government debt fell only one basis point to below 0.12% after spending $360.0 million – or two thirds of its intended QE allotment. All of this is to say that the healthiest nations – those with the least amount of debt to GDP – stand the best chance of gaining traction from stimulus. Besides Germany, those nations are few and far between among the “developed” crowd.

As we have mentioned many times, QE is losing its ability to stimulate economic growth worldwide. File it under the law of diminishing returns if you will. Sweden announced this week that it saw almost no result from its first foray into quantitative easing, where the yield on its five-year government debt fell only one basis point to below 0.12% after spending $360.0 million – or two thirds of its intended QE allotment. All of this is to say that the healthiest nations – those with the least amount of debt to GDP – stand the best chance of gaining traction from stimulus. Besides Germany, those nations are few and far between among the “developed” crowd.

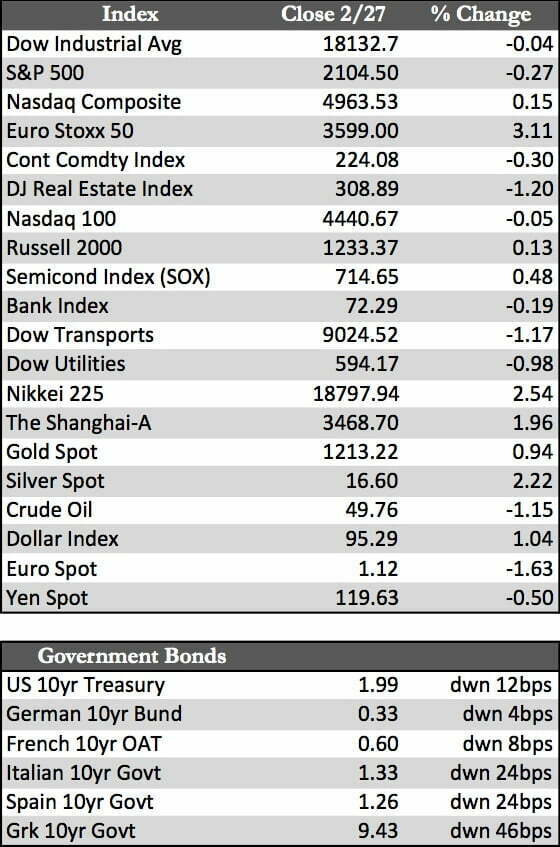

Here at home stocks were a bit more subdued in front of this week’s FOMC meeting. In that meeting Yellen served up the usual platitudes regarding inflation and the labor market (i.e., things are improving or just where they want them to be). However, the Fed did take its rate hike talk down a notch, promising to be “flexible” by responding to the data as it materializes. No other timetables or specifics were offered. In any case, U.S. stocks faded into Friday’s close following the comments, for no reason that I could see. It’s possible that leveraged speculators may be getting a little nervous that an “accident” may need to befall the markets before the Fed steps off the bench and into another round of QE.

Gold remained solidly above the $1,200 mark regardless of global demand concerns. The miners shrugged off a fairly mixed bag of earnings reports that included some hefty write-offs from the likes of Gold Corp and Pan American Silver, only to finish the week in the black. It may be the start of something positive when the metals refuse to fall given the negative news on balance. As for oil, reports that inventories are on the rise despite the falling rig count and fairly strong demand may have initiated a second-phase decline in the commodity. A breach of the $45.0 level for WTI would be interesting, and would open up some possibilities for investment in the sector. Meanwhile patience will be required as the variables in play have a chance to unfold.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP