Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed Slowly Catching Up to What Wall Street Already Knows

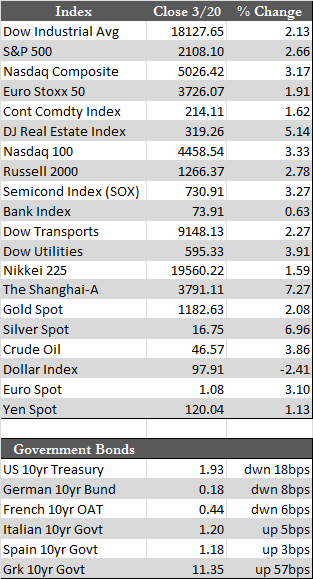

On Wednesday the Fed delivered exactly what speculators were hoping for – a reversion to a more dovish policy. Granted that they aren’t printing money just yet, insinuations are all anyone needs to spark a rally in stock-land. The Fed announced that there will be no rate hike in April, and that subsequent rate hikes, if and when they do occur, are likely to be executed at a slower pace than previously estimated. Slack in the labor and housing markets, in addition to “reasonable confidence” in maintaining its 2.0% inflation target, were cited as primary reasons for the decision. In any case, stocks were quick to act on the Fed’s dovish pronouncement, and erupted higher. The Dow enjoyed a near 300-point turnaround in a matter of minutes following the release. Away from equities, the likely yet still distant prospect of more QE put a bid back into Treasuries, punished the dollar, and subsequently revived the metals/commodities. Overseas markets responded in similar fashion. Were it not for another EU-threatening disruption in Greek austerity negotiations on Thursday, the gains might have been greater across the board by week’s end.

Keep in mind that the Fed and/or the US markets are now on course to join the other 17 central banks in stimulating their respective economies via money printing and/or debt-accumulation strategies. That’s something stock markets have banked on for quite some time now with the celestial run up in prices on any bad news. However, as we move closer to a QE-driven Fed, we must recognize that there is simply no way that all banks can have a weak currency and flood their bond markets at the same time. In a world of debtors, there must be at least one entity large enough to serve as creditor in the equation and buy up liquidity. There is no such entity, and without one, something will most likely give way. When that happens, ultra-levered stock and bond markets will look quite different, as will central bank credibility and defensive assets.

Keep in mind that the Fed and/or the US markets are now on course to join the other 17 central banks in stimulating their respective economies via money printing and/or debt-accumulation strategies. That’s something stock markets have banked on for quite some time now with the celestial run up in prices on any bad news. However, as we move closer to a QE-driven Fed, we must recognize that there is simply no way that all banks can have a weak currency and flood their bond markets at the same time. In a world of debtors, there must be at least one entity large enough to serve as creditor in the equation and buy up liquidity. There is no such entity, and without one, something will most likely give way. When that happens, ultra-levered stock and bond markets will look quite different, as will central bank credibility and defensive assets.

Sooner rather than later, stimulus will hit the proverbial brick wall – a time at which it will be unable to foster growth sufficient to support the markets with their existing debt loads. This dynamic is already evident in China (and perhaps Japan), where all monetary efforts have failed to curtail an ongoing deflation in housing. Whether we have reached this turning point here in the States is still a question for another quarter ahead – since the weather and the dollar have explained away the weakness found in retail, housing, and corporate earnings in general over the past several months. In the meantime, gold bugs can take comfort in the Fed’s long-awaited break from denial regarding the economy. That break is testament to the fact that things are not in fact so rosy, and haven’t been rosy all along in this so-called “recovery.” Combined with a break above $1,207 for gold, this may well be the right recipe for more “stealthy” gains in the weeks ahead. Time will tell.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP