Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Quarter-End Performance Gaming Fizzles

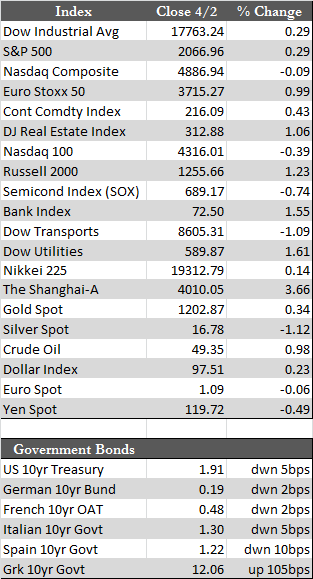

This week was essentially a wash in terms of market action. Stocks were sharply higher on Monday when dovish PBoC remarks prompted month-end gamers to ramp stocks higher into quarter-end. However, those gains evaporated over the next few days after another breakdown in Greece/ECB austerity negotiations and a lackluster ADP jobs report that fell short of expectations. Only 189,000 jobs were created, and, most of those (+170,000) appear to have come from small and medium-sized businesses. Larger firms’ actually lost jobs (down 34,000). Not much can be said about that other than that job growth should be more balanced if the economy were really firing on all cylinders. In any case, stocks were relatively flat heading into Friday’s non-farm payroll/employment report, Treasuries were weaker (though up on the week), and gold and the dollar were unchanged. Since markets will be closed tomorrow in observance of Good Friday, we’ll just have to wait and see how they react to the information during trade next Monday.

That said, the focus in the first few weeks of April should begin to shift towards 1st quarter results. I imagine there may be a few more flies in the earnings soup, outside the impact of a strong dollar, that the bulls have been conveniently ignoring. I have mentioned in past letters the few but significant corporate warnings and the last several months of fairly poor and not entirely weather-related economic data. Today’s ISM New York (Purchasing managers index, 50 for March vs. expectations of 62) and factory orders (0.2% for February, but with a negative revision of 0.5% to 0.7% for January) are just some of the more recent examples of this trend. In that light, it will be interesting to see if stocks will continue to edge lower into a long-overdue correction or push on into the next quarter relatively unfazed.

That said, the focus in the first few weeks of April should begin to shift towards 1st quarter results. I imagine there may be a few more flies in the earnings soup, outside the impact of a strong dollar, that the bulls have been conveniently ignoring. I have mentioned in past letters the few but significant corporate warnings and the last several months of fairly poor and not entirely weather-related economic data. Today’s ISM New York (Purchasing managers index, 50 for March vs. expectations of 62) and factory orders (0.2% for February, but with a negative revision of 0.5% to 0.7% for January) are just some of the more recent examples of this trend. In that light, it will be interesting to see if stocks will continue to edge lower into a long-overdue correction or push on into the next quarter relatively unfazed.

Happy Easter!

David Burgess

VP Investment Management

MWM LLLP