Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Greece Finally Matters

Before Friday’s news regarding Greece’s budding desire to go solo, US stocks on the whole were seen grinding higher as the majority of companies reporting for the first quarter were winning at the game of “beat the number” – rather handily in some cases. The market’s reaction to results has been mixed, depending on whether a firm’s shares were “oversold” or “overbought” prior to a better than expected release. Intel, for example, beat its lowered estimates and saw its shares recoup a month’s worth of losses. Goldman Sachs erased recent gains after beating estimates handily (by 41.0%) on across the board segment growth. But neither the headline numbers nor the randomness behind the market action is the main point. Rather, the point is that there is still a fair amount of financial engineering in the numbers when one considers they’re still “beating” regardless of lower GDP growth, a strong dollar, a degree of cold weather, and sluggish Asian economies. One trillion dollars will be spent on buybacks this year to augment what I see as a lack of organic growth, and much of that will be financed at the expense of corporate balance sheets via the use of leverage (or debt) – which is expanding at record pace again to start 2015.

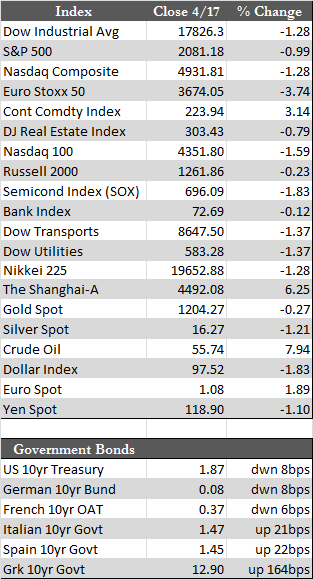

In any case, I believe that that is why the Greek bankruptcy spurred markets into a bit of panic on Friday. “Growth” as we know it today hinges on ever-increasing access to credit markets – not just by Greece but by virtually every developed nation. Keep in mind that Greece could possibly reach a deal that would provide an additional €7.2 billion of life support. However, this, as we’ve said here many times before, would only delay the inevitable default. What’s different now is that the market is beginning to believe this outcome is a foregone conclusion in the case of Greece, with the implication that the same could be true for other PIIGS nations down the pike. Many PIIGS-nation 10-year rates, after a bludgeoning this week, are trading higher than where they were before the ECB began its QE buying program in March.

In any case, I believe that that is why the Greek bankruptcy spurred markets into a bit of panic on Friday. “Growth” as we know it today hinges on ever-increasing access to credit markets – not just by Greece but by virtually every developed nation. Keep in mind that Greece could possibly reach a deal that would provide an additional €7.2 billion of life support. However, this, as we’ve said here many times before, would only delay the inevitable default. What’s different now is that the market is beginning to believe this outcome is a foregone conclusion in the case of Greece, with the implication that the same could be true for other PIIGS nations down the pike. Many PIIGS-nation 10-year rates, after a bludgeoning this week, are trading higher than where they were before the ECB began its QE buying program in March.

Aside from the slide in stocks, Treasuries were a tad firmer, currency markets rebalanced against the dollar, and gold essentially moved sideways until Friday when it experienced a decent uptick. Stocks may bounce back a little on Monday, given that the Greece situation will likely be spun as a one-off, country-specific issue. But if bond markets overseas continue to inch lower despite the best efforts of central bank stimulus programs, stocks could struggle regardless of any positive earnings surprises. It could also mark the beginning of a more powerful up-move for gold, but that prediction may still be a bit premature given that the Greek negotiations and the earnings season have yet to completely filter through.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP