Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bigger Things to Consider than the NFPs…

(NFP = Non-Farm Payroll, or “jobs created”)

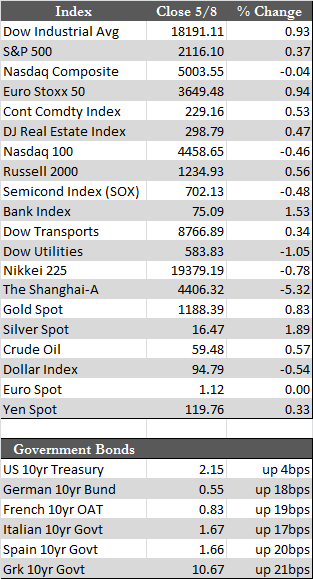

If it weren’t for the Fed’s exaggerated focus on jobs, this week’s NFP report, which turned out to be rather uneventful, would not have had the impact on worldwide markets that it did (in either the pre- or post-release phases). NFPs registered a 223,000 increase for April, which was below the expected 228,000 (if that means anything), but well above the March results that saw a negative adjustment of 41,000 to 85,000. The results were enough to satisfy the bulls by reinforcing their twin beliefs in a second-half recovery and another delay in Fed rate hikes. The latter, if you recall, were originally intended to commence in April. In any case, the market action that followed on Friday was atypical, as just about everything turned wildly green at the open. The unexpected spike in stocks must have triggered a flurry of short covering and/or quant/algorithm traders getting long – all in relatively low-volume trade. Stocks peaked just before noon, at which time the rally began to fade. Even so, it managed to retain most of the day’s gains leading into the close. A late-in-the-day merger announcement from Visa helped in that regard.

As we move beyond the jobs report, I imagine the markets will get back to discounting the much larger elephant in the room, which is the veracity of QE-driven markets altogether. Bond yields in Europe are now higher than they were in March when the ECB began buying the region’s debt. Further, and to the chagrin of most experts, rates are rising at a time when economic growth and the stock market appear to be decelerating again (similar dynamics are at work in Japan and China). Last night, data showed eurozone output and services missed forecasts and expanded at a slower pace in April. Both stocks and bonds were lower at the start of overnight trade Thursday, as they were all week, and that tone would probably have carried over into U.S. markets if not for the hype surrounding the U.S. jobs report.

As we move beyond the jobs report, I imagine the markets will get back to discounting the much larger elephant in the room, which is the veracity of QE-driven markets altogether. Bond yields in Europe are now higher than they were in March when the ECB began buying the region’s debt. Further, and to the chagrin of most experts, rates are rising at a time when economic growth and the stock market appear to be decelerating again (similar dynamics are at work in Japan and China). Last night, data showed eurozone output and services missed forecasts and expanded at a slower pace in April. Both stocks and bonds were lower at the start of overnight trade Thursday, as they were all week, and that tone would probably have carried over into U.S. markets if not for the hype surrounding the U.S. jobs report.

As for the metals, they seem to be caught in a transitory state of limbo. Foreign demand has most likely calmed given the euro’s modest rebound against the dollar. And what could have been an American-led rally in the metals at the specter of a topping out in the dollar has been thwarted by the easily revived and readily apparent optimism in US stocks. But in light of events now unfolding overseas, all of this is due to change if QE continues to under-deliver. Trading beyond Monday next week will provide us with additional clues as to what direction markets want to go. Europe may dictate the action, but keep in mind that U.S. stocks, after having a soft first quarter, are headed into a seasonal soft patch between now and October. Things could get interesting…

Best Regards,

David Burgess

VP Investment Management

MWM LLLP