Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Waiting on More “Data”-Derived Clues

Overseas equity markets finished the week on a rather bearish note as they wrestled with the prospect of a Fed rate hike, Greece’s upcoming €300 million payment to the IMF, and China’s tightening of the noose around its runaway margin lending. US stocks moved in sympathy, but declines were tempered by month-end performance gaming and increased merger speculation (i.e., Avago/Broadcom and Intel/Altera). Year-to-date merger and acquisition activity is up a record-setting 52.0% (to $746.9 billion) in the US and 35.0% (to $1.7 trillion) globally. Although those numbers are impressive, they are largely a function of corporate efforts to obfuscate the factors responsible for the decline in earnings over the last two quarters. At any rate, US markets were held to modest losses thanks to speculation in the NASDAQ, which incidentally hit a new high on Wednesday. Treasuries benefitted nicely from the rotation away from stocks, while the dollar extended recent gains against the backdrop of a faltering euro.

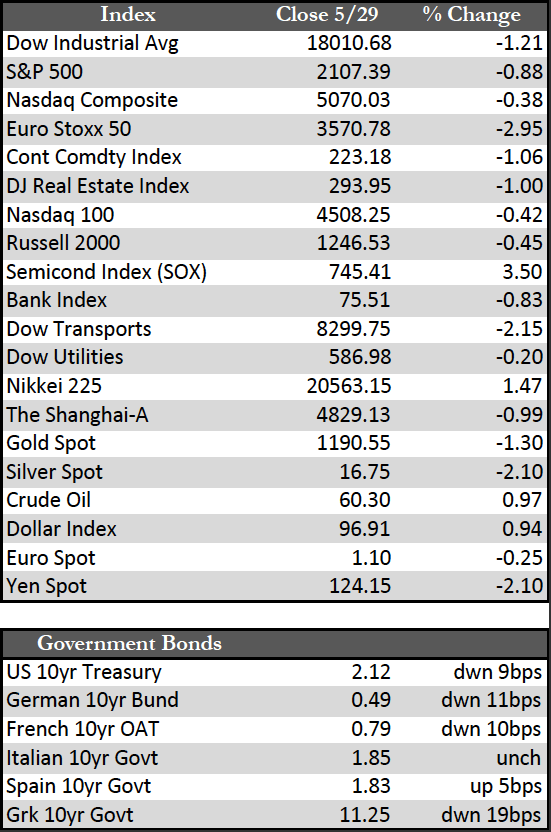

MWM 15, 5-29 Box Scores  As we move past June 1st, it will be interesting to see if the bulls can keep the momentum alive in stocks. As stated in last week’s recap, the rally we have seen lacks both fundamental and technical internals to support it. US economic data beyond April’s post-weather bounce has begun to taper off in May, while the Dow Transports, after having set a new interim low this week, bearishly refuses to confirm the new high set in the Dow Industrials. The last time this happened on a consistent basis was prior to the 2008 crisis. It also may be worth mentioning that US margin debt hit a new all-time high at the end of April, up $31.0 billion to $507.0 billion. Arguably there could be some shorts mixed in with that tally, but, as is customary at market tops, the debt represents longs more often than not. It could add downside drag to equities if the second-half recovery continues to be elude.

As we move past June 1st, it will be interesting to see if the bulls can keep the momentum alive in stocks. As stated in last week’s recap, the rally we have seen lacks both fundamental and technical internals to support it. US economic data beyond April’s post-weather bounce has begun to taper off in May, while the Dow Transports, after having set a new interim low this week, bearishly refuses to confirm the new high set in the Dow Industrials. The last time this happened on a consistent basis was prior to the 2008 crisis. It also may be worth mentioning that US margin debt hit a new all-time high at the end of April, up $31.0 billion to $507.0 billion. Arguably there could be some shorts mixed in with that tally, but, as is customary at market tops, the debt represents longs more often than not. It could add downside drag to equities if the second-half recovery continues to be elude.

Though technically range-bound, the precious metals have reacted favorably on days the US dollar appeared to be in the act of topping out and then retreating. The dollar has set a series of lower highs (two, to be precise), but traders have yet to embrace the moves as anything but profit-taking opportunities thus far. That will likely change when folks drop the fantasy that the Fed can actually tighten in exchange for a more dovish perspective. Given the news, I would have to believe that we are building into that revelation (albeit slowly) as both the economy and the markets have begun to teeter in the absence of Fed QE. This is not to say that QE is the cure for what ails us; I believe QE will make matters worse. But the talk of it is likely to ignite a shift in demand for assets to hedge against the dollar. In that regard, I suspect traders will be waiting on next Friday’s jobs report for more clues.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP