Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bonds Ache; Equities Have Yet to Quake

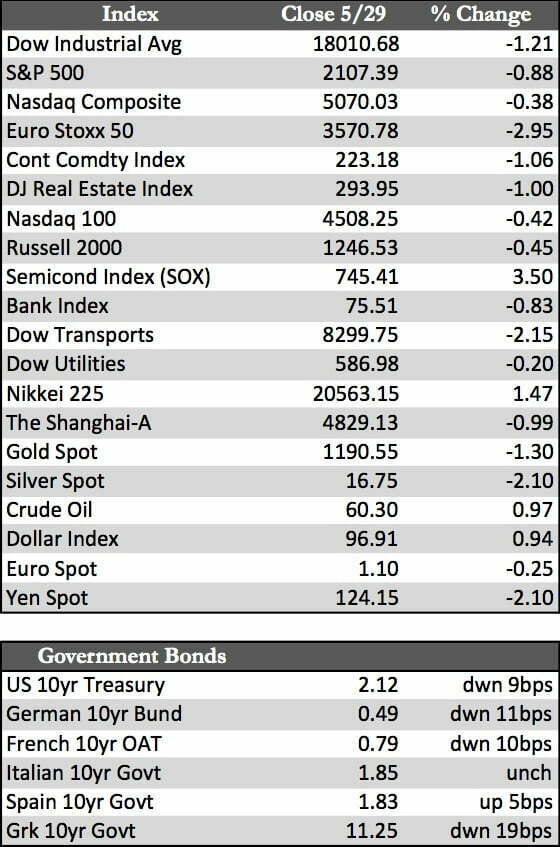

If you recall, it was only a few weeks ago that we experienced a bounce in world debt markets that led to a technically uneventful but nonetheless frenzied all-time high in the Dow Industrials. This week that bond market rout resumed – in grand fashion, no less – with key 10-year sovereign bond prices in the U.S., Europe, Japan, and China at new lows and rates at new highs for the year. From the vantage point of equity markets, at least here at home, the sharp decline in bond prices simply hasn’t mattered. Stocks have remained relatively stable thus far. Bulls, I’m sure, have relegated rising rates to the context of demand-pull inflation or a “liquidity” driven phenomenon. But those theories lose credibility when weighed against an economic “recovery” now five years old and the dearth of supply in debt securities to which we have herein made reference on several occasions. Despite the excuses, and for whatever the reason, a short-term capitulation in world bond markets seems to be underway. Whether the bulls like it or not, it stands a chance of impacting equity markets in a profound manner. For now, though, the bulls are still having things their way.

The economic data released this week is barely worth mentioning, as I believe it took a back seat to bond market activity. The recent rise in long-term rates may have sparked some panic buying among higher-ticket items (i.e., autos and homes), but it’s a trend that may end quickly if rates decide to move meaningfully higher from here.

The economic data released this week is barely worth mentioning, as I believe it took a back seat to bond market activity. The recent rise in long-term rates may have sparked some panic buying among higher-ticket items (i.e., autos and homes), but it’s a trend that may end quickly if rates decide to move meaningfully higher from here.

As for the metals, in decades past higher rates would often go hand-in-hand with higher gold prices. But as long as the consensus view sees higher rates as a function of an improving economy or the dollar as simply consolidating off its highs, the metals may continue to be under some pressure. That said, gold managed a nice bounce off the technical support level $1,162 to finish the day at $1,172 on Friday. The price itself may not be flattering, but the price action continues to suggest better things to come.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP