Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Volatile Week Waiting on Greece

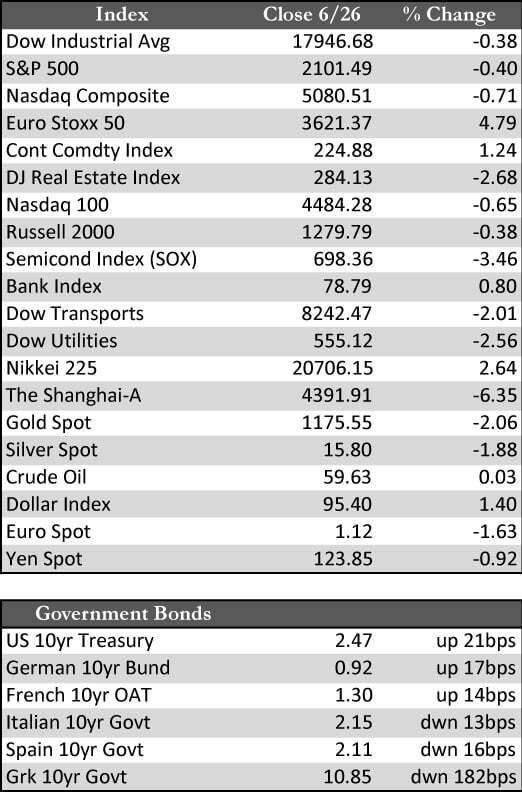

Those hanging their hats on the consummation of a Greek “deal” this week were once again disappointed. After long discussions between Greek, ECB, IMF and European Banking Commission officials, terms that would permit an extension of credit amounting to a mere €7.2 billion could not be reached. That failure may suggest that fiscal matters in Greece are so far beyond repair that the negotiations are really just an elaborate exercise to find a scapegoat, but that’s all a guess on my part. At last look, Greece has been offered a deal that frees up over $17 billion with which to pay its bills. The offer expires next Tuesday, but Tspiras has already called it “blackmail” because it involves austerity measures the ruling Syriza party and the people of Greece will not tolerate. The chances of its acceptance are therefore, to say the least, rather slim. In any case, markets were whipsawed by the unfolding of these events and ended the week in somewhat mixed form. European stocks bounced from relatively depressed levels, while US stocks withdrew from recent highs. Worldwide bond markets were flattish (which excludes a failed bond auction in China), the dollar was marginally stronger against the euro, which in turn pressured gold into the lower end of its range.

On the US data front, we had new (up 2.2% month-over-month) and existing home sales (+5.1%) in May that for the most part seemed decent. I say “seemed” because the gains have been set against the backdrop of a threatening rise (up 45 basis points from April lows to 4.18%) in mortgage rates. Durable goods orders in May were also deemed a success, but the 0.5% increase, excluding transports, was sullied by a negative 0.8% revision (to -0.3%) of April’s results. And first-quarter GDP was revised up from -0.7% to -0.2%, which may not be saying much since the improvement was largely due to an increase in inventories and a negligible increase in consumer spending.

On the US data front, we had new (up 2.2% month-over-month) and existing home sales (+5.1%) in May that for the most part seemed decent. I say “seemed” because the gains have been set against the backdrop of a threatening rise (up 45 basis points from April lows to 4.18%) in mortgage rates. Durable goods orders in May were also deemed a success, but the 0.5% increase, excluding transports, was sullied by a negative 0.8% revision (to -0.3%) of April’s results. And first-quarter GDP was revised up from -0.7% to -0.2%, which may not be saying much since the improvement was largely due to an increase in inventories and a negligible increase in consumer spending.

Those things considered, nothing so far has put a meaningful dent in the optimism of stock bulls. However, with the Fed’s QE sidelined at a time when perceptions are locked on to a recovery that has yet to materialize, a market dislocation in stocks becomes all the more probable. With or without a favorable outcome to Greece’s financial issues, our focus will turn back to world bond markets, where it’s likely that interest rates will continue where they left off a few weeks ago – moving higher. At some point, the gold market will recognize this trend for what it is – inflationary and/or a precursor to a funding crisis – but at the moment optimism has blinded folks to that fact.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP