Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Pre-crisis Gold Selling Reveals a Desperate China

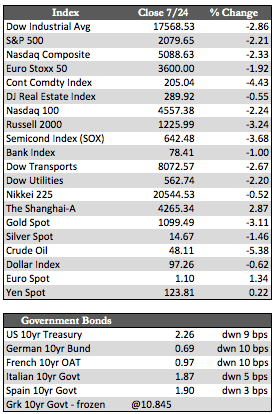

In market action Thursday, it appeared that stocks were suffering from fatigue when an early attempt at “buy the dip” was countered by some fairly motivated selling. Stocks remained weak from mid-morning on, and the major indexes finished with moderate losses. Things might have been worse if not for Amazon’s report at the close. It won at beat-the-number as its revenue and earnings showed marked improvement. Like Google and Netflix, cost cutting or a lack of spending provided the boost to the bottom line. Amazon showed a profit of $0.19 a share, or $92 million in aggregate profit, and its shares soared 17.21% (83 points) to $565.17 in after-hours trade Thursday. At that earnings rate, the forward P/E would be just shy of 750. Considering that the retailer is already about the size of Target in terms of sales, investors may want to approach Amazon shares with some caution.

Though the existing home sales and jobless claims numbers were better than expected, any benefit they could bring to the market was muted by the swath of corporate earnings releases released during the week. Keep in mind that both Apple and Intel (to name just a few) have cut about $1 billion each from cap-ex over the next year. This will no doubt have an impact on jobs, especially in the tech sector, and may also help explain the weakness in Apple-supplier shares (e.g., Taiwan Semiconductor) during the week.

Though the existing home sales and jobless claims numbers were better than expected, any benefit they could bring to the market was muted by the swath of corporate earnings releases released during the week. Keep in mind that both Apple and Intel (to name just a few) have cut about $1 billion each from cap-ex over the next year. This will no doubt have an impact on jobs, especially in the tech sector, and may also help explain the weakness in Apple-supplier shares (e.g., Taiwan Semiconductor) during the week.

In an odd turn of events, gold was pounded in overnight trade on Sunday. The seller that tried to remain anonymous was in fact China, which sold a portion (57 metric tons) of its holdings (1,658 metric tons) in short order, causing the price to tumble quickly. Keep in mind that China and many of its state-owned businesses are struggling to stay out of bankruptcy, so it’s not unreasonable to assume that China is 1) trying to pay the bills while 2) keeping its factory profits running on cheap commodities. Also remember that gold may be the one asset China can sell without further impairing its markets. In any case, this sort of selling is having less and less of an impact on the gold price compared to 2013 – and suggests that gold is more likely to turn up than down in the near future. As I indicated last week, however, the optimism in stocks will need to settle down a bit further before this happens.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP