Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Like It or Not, Higher Rates (Inflation) Pose Meaningful Risks

The Dow continued its march toward 20,000 to start the year. It’s being fueled by Trump policy optimism and by the notion that higher costs, whether in oil, wages, or credit, must mean that the economy is accelerating or that greater profits will soon to drop to the bottom line in terms of corporate earnings. At least, that’s the prevailing theory to support the lunacy ongoing in stock prices. The other, less publicized, theory is that bond prices have fallen (rates have risen) because of a non-voluntary breakdown in the balance of the financial markets. That represents a new dysfunction which, as we have mentioned here before, central banks are having difficulty controlling. It’s my assumption that the latter is the case, and when we see upticks in overall spending and subsequent manufacturing (as reported for China and the US in December) it is largely the result of a growing trend to spend and thereby stay ahead of the curve of expected price increases. In any case, it’s a self-reinforcing process that has a tendency to develop without much warning. As to its longevity, I remain dubious. Meaningfully higher costs of any kind usually precede recessions, not expansions for deficit-stricken nations such as our own.

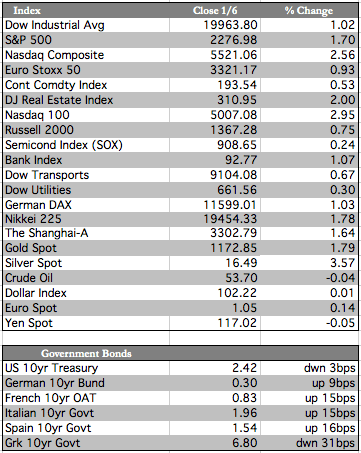

Away from stocks, Treasuries managed a small gain while the dollar fell – both developments due to the fact that the most recent FOMC minutes suggest the Fed will not hike rates any more than previously expected. That news, combined with the increase in inflation expectations, has been rather good to the metals. Gold has tacked on nearly 45 points from the lows in December and is now set to test the upper limits of the 50-day moving average at $1,191. Crude oil prices traded sideways around $53/bbl. in reaction to offsetting inventory data (between oil [-] and gasoline [+]). Overall commodity prices rose 1.5%, as measured by the Continuous Commodity Futures Price Index (or CCI) – though the CCI remains 2.17% below the high set last year in July.

Away from stocks, Treasuries managed a small gain while the dollar fell – both developments due to the fact that the most recent FOMC minutes suggest the Fed will not hike rates any more than previously expected. That news, combined with the increase in inflation expectations, has been rather good to the metals. Gold has tacked on nearly 45 points from the lows in December and is now set to test the upper limits of the 50-day moving average at $1,191. Crude oil prices traded sideways around $53/bbl. in reaction to offsetting inventory data (between oil [-] and gasoline [+]). Overall commodity prices rose 1.5%, as measured by the Continuous Commodity Futures Price Index (or CCI) – though the CCI remains 2.17% below the high set last year in July.

I make mention of the CCI only because the idea that the economy is getting hotter has yet to become manifest in the form of broadly higher commodity prices. There also hasn’t been any real proof that higher long-term interest rates are in fact aiding secular builds in consumption within critical areas such as homes/autos and construction, where leading indicators continue to flash negative. This would imply that stocks are operating on borrowed time, but any meaningful consolidation may have to wait until the economic data turns weaker in a broader sense or technical flirtations with a 20K Dow come to an end. As for the timing of such revelations, it’s always hard to pinpoint the exact day, but I do believe we are talking in terms of months, perhaps even weeks, but certainly not a year, before these and other bearish issues start to take hold.

Best Regards,

David Burgess

VP Investment Management

MWM LLC