Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bond Markets Will Ultimately Dictate

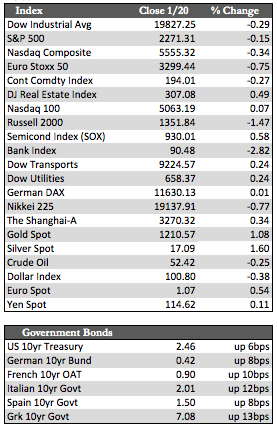

There was quite a bit in the news for the market to digest this week, including the possible Brexit contagion, Trump’s inauguration, corporate earnings, merger speculation, the ECB policy meeting, and a U.S. options expiry. But the interesting thing was that equity markets could not capitalize on any of these ostensibly bullish events to launch stocks higher. Specifically, after all the hype surrounding financial sector earnings released last Friday, shares of the majors (i.e., Citi, Wells Fargo, JPM, Bank of America, and Goldman Sachs) had a difficult time extending their rallies to interim highs. The KBW Bank Index closed about 3.0% lower for the week. Again we have the usual standouts, such as Netflix and possibly other members of the FANGs group, but for the broader market it just may be that the equities are ready to deal with certain realities. Chief among these is the fact that while what Trump has promised fiscally and tax-wise may (or may not) bode well for the economy, it affects financial markets adversely.

In that vein, bond markets worldwide continued to slip, most notably in Europe. The German 10-year Bund yield touched on a new year-to-date high of 0.42%, French and Austrian bonds of the same duration also broke out to new interim highs, and the rest of Europe, Asia, and US Treasury yields were seen trailing in sympathy. As I have said here before, I consider this a negative consequence or (dis)function of central bank QE, not a manifestation of increased inflation expectations due to economic growth. In fact, expectations have gone in the opposite direction because there have been very few signs of consistent economic growth in recent economic data. The CPI, PPI, and commodity price, retail, and manufacturing data have remained subdued throughout this upward cycle in rates.

In that vein, bond markets worldwide continued to slip, most notably in Europe. The German 10-year Bund yield touched on a new year-to-date high of 0.42%, French and Austrian bonds of the same duration also broke out to new interim highs, and the rest of Europe, Asia, and US Treasury yields were seen trailing in sympathy. As I have said here before, I consider this a negative consequence or (dis)function of central bank QE, not a manifestation of increased inflation expectations due to economic growth. In fact, expectations have gone in the opposite direction because there have been very few signs of consistent economic growth in recent economic data. The CPI, PPI, and commodity price, retail, and manufacturing data have remained subdued throughout this upward cycle in rates.

In any case, the metals seem to be responding favorably to the prospect of more inflation, whether because of a broken bond market or an improving economy, as gold gained 0.85% to silver’s 1.57%. Both stand to test the upper limits of their respective 100- and 200-day moving averages, and judging by this week’s price action, that may happen in the next handful of days. I suspect we may soon have a small interruption, but not a derailing, of that momentum when perceptions change with respect to economic conditions.

Best Regards,

David Burgess

VP Investment Management

MWM LLC