Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks All Levered Up and No Revenues to Show

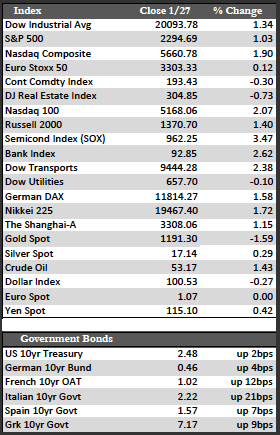

To start the week, equity markets both here and abroad were able to build on the post-election momentum with the Dow leading the charge, this time above the well-publicized yet irrelevant 20,000 “milestone.” Behind that move we had essentially two contributors: decisions made by the Trump administration and corporate earnings, though the latter in my opinion came up short of expectations. Revenue growth, using the Dow components as a measure and factoring out mergers, has thus far been virtually non-existent away from the bank/insurance companies. Intel was an exception, with just over 10% revenue growth (mostly organic) year over year, but even that growth was not necessarily due to PC sales, but to cloud and newly added mobile products (via Apple). I mention all of this because it’s just a bit more data that draws an increasingly complete picture – to wit, there is absolutely no veracity to the assumption being made everywhere that the rise in long term rates that began more than six months ago is indicative of economic growth and/or inflation.

Recent economic data continues to show signs of the opposite. US new home sales for December declined by 10.4% versus the -0.7% expected by economists. Mortgage rates really popped following the election, by about 50 bps (or a half percent) to around 4.10% by mid-December. That said, I didn’t expect any negative impact on housing to turn up until sometime early this year – but here we are. Aside from the housing data, jobless claims rose in the latest week from 237,000 to 259,000, which keeps a bearish trend in place YTD. Then again, claims can be both fudged and volatile – so I’m taking that number in stride.

Recent economic data continues to show signs of the opposite. US new home sales for December declined by 10.4% versus the -0.7% expected by economists. Mortgage rates really popped following the election, by about 50 bps (or a half percent) to around 4.10% by mid-December. That said, I didn’t expect any negative impact on housing to turn up until sometime early this year – but here we are. Aside from the housing data, jobless claims rose in the latest week from 237,000 to 259,000, which keeps a bearish trend in place YTD. Then again, claims can be both fudged and volatile – so I’m taking that number in stride.

As for gold, I mentioned last week that there could be a disruption in near-term price momentum if expectations about post-election economic growth and/or inflation were to moderate. I believe earnings and housing results pushed things that direction this week. But given that gold found decent support above its 50-day moving average and that the miners held steadily to recent gains, I would say that the metals were already primed to respond to any weakness in stocks – which at this point could happen prospectively. To put it a different way, while I believe Trump’s policy changes are predominantly good for the country, I am skeptical that they will be enough to steer us clear of a financial unwinding if debt markets continue to revolt against the efforts (QE) of central bankers.

Best Regards,

David Burgess

VP Investment Management

MWM LLC