Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Trump Rally Nods to the Fed

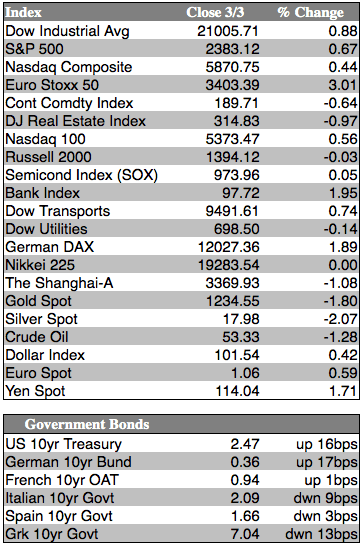

Early on this week, stocks both here and abroad (ex-China) were marginally higher ahead of Trump’s Congressional address Tuesday night, in which he outlined rather effectively his determination to “make America great again.” Not only did Trump’s approval rating improve to 7 out of 10 people, but the Dow also tacked on a cool 300 points to break above 21,000 for the first time. Viewers said that Trump appeared to be more Presidential than in the past, with which I would have to agree. Nonetheless Trump is dead on, when he says that he has inherited a “mess,” a mess mind you that we the people, government, and Wall Street (including banks and hedge funds) created over the last few decades. As such, I don’t believe it’s particularly fair and or wise to lay the onus on Trump to fix or avoid the consequences of more than 20 years’ (including the last few months, of course) worth of financial promiscuity – and without a hitch. But unfortunately, I think that’s precisely what has developed in the minds of voters and (stock) investors. In any case, by the end of the week, a more moderate tone developed in stocks as the market began to focus more on the words of Janet Yellen, who said late Friday that a rate hike at the next FOMC meeting March 15th would be “appropriate” amid what she described as “smooth sailing” in the economy.

On that note, I would like to point out that the latest earnings season (4th quarter 2016) is more than 95% complete at this time. Reported earnings thus far have come in much lower than expected, at $25.32 among firms in the S&P 500. To put that in perspective, that number is 4.4% lower than where we were in the 4th quarter 2013, yet the S&P 500 is 30.0% higher today than it was back then. Intrinsically, that comparison gets worse when you consider the fact that corporations have spent over $1.2 trillion since 2015 buying back their shares to artificially boost EPS results. Anyway, we’ll soon get to hear from a few companies about how the first quarter of this year is shaping up, but it seems clear to me that the bar has been set extremely high in terms of expectations.

On that note, I would like to point out that the latest earnings season (4th quarter 2016) is more than 95% complete at this time. Reported earnings thus far have come in much lower than expected, at $25.32 among firms in the S&P 500. To put that in perspective, that number is 4.4% lower than where we were in the 4th quarter 2013, yet the S&P 500 is 30.0% higher today than it was back then. Intrinsically, that comparison gets worse when you consider the fact that corporations have spent over $1.2 trillion since 2015 buying back their shares to artificially boost EPS results. Anyway, we’ll soon get to hear from a few companies about how the first quarter of this year is shaping up, but it seems clear to me that the bar has been set extremely high in terms of expectations.

Away from stocks, Treasuries and high quality EGBs were a bit weaker, as the “risk on” trade that followed Trump’s speech favored the peripherals (i.e., the PIIGS). Crude oil ended the week mixed, as Russia was seen balking on recent pledges made with OPEC over production cuts and Libya’s largest oil port was seized by the “Benghazi Defense Brigade” (all we know is they aren’t backed by the UN). Gold, silver, and the miners consolidated recent gains, finishing off 1.8%, 2.11%, and 8.0% respectively. As I said last week, it appeared that the metals were ripe for a pullback, given extremely short term fundamental (not technical) backdrop. Now that we seem to have one, I am expecting it to be rather shallow, but I’ll be paying close attention to the price action in the coming days and/or weeks to monitor that hypothesis. Gold should be expected to hold around $1,205 on the chart, but, as I said, we’ll just have to wait and see.

Best Regards,

David Burgess

VP Investment Management

MWM LLC