Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Wondering if Trump Reforms Are Already Priced In…

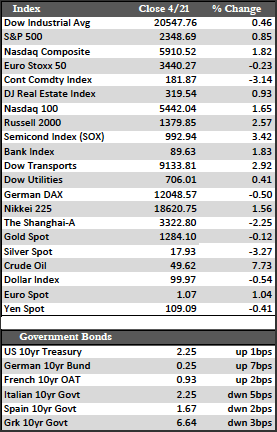

Stocks managed to recoup some of last week’s losses as the major indices rallied to add about a percent, on average. NASDAQ stocks touched on a new high, but the real outperformers were in the Dow Transports. They led the way this week with a 2.6% gain. Geopolitical tensions subsided – or, perhaps better said, they didn’t escalate – in such places as North Korea. This allowed traders to shift their focus to other areas – in this case, the introduction of a new healthcare bill capable of wooing the much-needed Freedom Caucus votes, a tax/regulatory reform package, and, of course, US first-quarter earnings reports. I don’t have much to go on when it comes to healthcare and tax reform because we have yet to see the final results. However, for those who wish to preview the possibilities, we have posted on our home page a few articles that speculate on the results of each.

As for earnings, I can’t say that there have been any major standouts – at either the company-specific or industry level (ex the banks). With the prospect of “massive” tax cuts coursing through the markets’ veins, investors seem more content with earnings “beats” and the artificial contribution of share-buybacks than with actual growth. (For those who might not know, beating earnings estimates is not a major feat given that companies set their own estimates prior the release of an earnings report. Year-to-date, those estimates have been revised lower by 6.2% for firms in the S&P 500.) Bank earnings have been deemed “good,” though one might look askance at the $432 billion in leveraged loans made in the first three months of the year as the reason that earnings were better than expected from the group. These are high yielding, high risk, hence highly profitable loans made to entities already swimming in debt. So while bank earnings may look all right on the surface, they are actually of low quality underneath.

As for earnings, I can’t say that there have been any major standouts – at either the company-specific or industry level (ex the banks). With the prospect of “massive” tax cuts coursing through the markets’ veins, investors seem more content with earnings “beats” and the artificial contribution of share-buybacks than with actual growth. (For those who might not know, beating earnings estimates is not a major feat given that companies set their own estimates prior the release of an earnings report. Year-to-date, those estimates have been revised lower by 6.2% for firms in the S&P 500.) Bank earnings have been deemed “good,” though one might look askance at the $432 billion in leveraged loans made in the first three months of the year as the reason that earnings were better than expected from the group. These are high yielding, high risk, hence highly profitable loans made to entities already swimming in debt. So while bank earnings may look all right on the surface, they are actually of low quality underneath.

Away from stocks, Treasuries held to modest gains despite the strength in stocks and statements made by certain Fed officials that reaffirmed planned interest rate increases. The dollar was a bit weaker, primarily against the euro, ahead of this weekend’s primary elections in France. A win by anti-establishment candidate Le Pen (currently dead even in the polls) may create some turbulence between France and EU authorities – not to mention markets – but we’ll just have to wait and see.

Turning to the metals, gold was damaged a bit by a motivated seller in the futures pits on Wednesday, but the move appeared to have no momentum that would cause significant technical damage. Gold finished the week with virtually no change and in technically sound condition. Silver, on the other hand, lost about 3.2% – for what reason I am not entirely certain. As I have said before, silver does have the tendency to lose ground at the onset of a contraction in economic conditions, which may indeed be the case at this juncture. Therefore I don’t view the recent selling in the metals as anything outside the norm given the gains we’ve just had. However, those looking for the metals to resume their upward trajectory may have to wait a few weeks until the markets have had a chance to digest a few of the aforementioned Trump reforms.

Best Regards,

David Burgess

VP Investment Management

MWM LLC