Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Post-election Inflection Point?

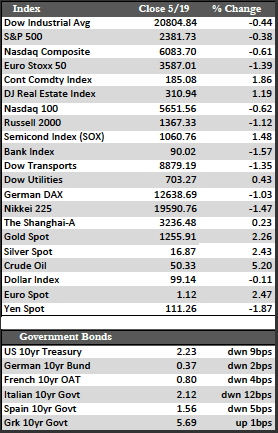

After Wednesday’s political upheaval that crushed the markets, stocks spent the remainder of the week trying to take it all back. By week’s end, the Dow had recouped about 53%, or 203 points of its 372-point loss. The Dow now sits just above its 50-day moving average, at 20,804.84, in what seems to be a comfortable position ahead of Monday’s open. We’ll just have to wait and see if the bulls can push these markets (especially the Dow and S&P) to new highs, which they have been trying to do without much success since February this year. If more downward movement occurs, I am not sure the Dems will have much to do with it, as they have zero evidence to support the prosecution against Trump. Even if they did, they don’t seem eager to take responsibility for what would be a total market collapse in response. I am still of the mind that stocks can start to “correct” themselves at any time, and for any number of valid reasons – not least of which is the fading of the pipe dream that Trump can solve all our fiscal problems with very little consequence for the financial markets.

Away from stocks, the dollar was noticeably weaker, as “all is now right” in Europe under Macron. The dollar fell to the pre-US election level of 97.11, while the metals rallied, with gold adding 2.26% to silver’s 2.43%. Treasuries and European government bonds held to modest gains during and after Wednesday’s shellacking in stocks, while crude oil rallied above 50 on the notion that OPEC and Russia would extend their current production cuts – which anyone paying attention should find laughable. US housing starts and building permits declined in April (on a month-over-month basis) by 2.6% and 2.5%, respectively. New and existing home sales numbers will be released next week.

Away from stocks, the dollar was noticeably weaker, as “all is now right” in Europe under Macron. The dollar fell to the pre-US election level of 97.11, while the metals rallied, with gold adding 2.26% to silver’s 2.43%. Treasuries and European government bonds held to modest gains during and after Wednesday’s shellacking in stocks, while crude oil rallied above 50 on the notion that OPEC and Russia would extend their current production cuts – which anyone paying attention should find laughable. US housing starts and building permits declined in April (on a month-over-month basis) by 2.6% and 2.5%, respectively. New and existing home sales numbers will be released next week.

I’ve had the general feeling lately that the metals would start to rebuild. I am not pleased they chose to start building on the heels of political turmoil, but bull markets do need triggers. That said, I don’t imagine there is anything holding gold back from the $1,300 level. If it breaks through, $1,350 should be the next testing ground. Also, where applicable for MWM portfolios, I will be looking for an opportunity to swap a little gold for silver in anticipation of a much better second half for the metals.

Best Regards,

David Burgess

VP Investment Management

MWM LLC