Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Are We Finished Yet?

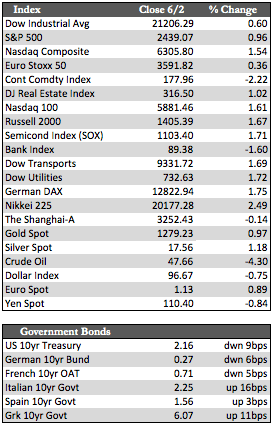

After the better-than-expected ADP employment change of +253,000 released on Wednesday, stocks wasted no time pushing through old highs to set new records. The action didn’t include the Dow Transports, however, which have yet to join and confirm the Dow Industrials in breakout territory. Those who are interested can check the box scores for the tally. Otherwise, there’s not much more to say about the market action. Psychology and technical price points, not fundamentals, are ruling the day. That essentially means the rally is running on fumes, and can easily change direction given the right catalyst. Whether that’s second-quarter earnings season or a setback for the Trump administration, I’m really not sure. I just know that stocks are extremely vulnerable at these levels given how things have been financed (i.e., leveraged loans).

Trump’s decision to withdraw the US from the Paris Climate Accord was about the most bullish thing that happened this week. Though I’m not sure the opt-out changes our current position much, it will prevent the loss of an estimated 2.7 million US jobs (to countries overseas who bear very few liabilities under the plan) over the next several years. As I mentioned, the ADP employment change was deemed a success at +253,000, but with the US non-farm payrolls registering 138,000 on Friday, it seems that temporary jobs made the difference in the ADP report. US pending home sales fell 1.3% in April (-5.4% year-over-year), US vehicle sales retreated to a fresh low for the year of 12.84 million in May, and the trade balance (deficit) in April rose to $47.6 billion from $45.3 billion in March. Aside from this news, ISM and other manufacturing (opinion polls) looked rather normal.

Trump’s decision to withdraw the US from the Paris Climate Accord was about the most bullish thing that happened this week. Though I’m not sure the opt-out changes our current position much, it will prevent the loss of an estimated 2.7 million US jobs (to countries overseas who bear very few liabilities under the plan) over the next several years. As I mentioned, the ADP employment change was deemed a success at +253,000, but with the US non-farm payrolls registering 138,000 on Friday, it seems that temporary jobs made the difference in the ADP report. US pending home sales fell 1.3% in April (-5.4% year-over-year), US vehicle sales retreated to a fresh low for the year of 12.84 million in May, and the trade balance (deficit) in April rose to $47.6 billion from $45.3 billion in March. Aside from this news, ISM and other manufacturing (opinion polls) looked rather normal.

Again, I would say the net balance of that economic data would not corroborate the bulls’ attitude or Trump’s recent statement that the economy is “absolutely tremendous.” But hey, we still have a tax cut (that the government can afford) to look forward to, right? In any case, Treasuries and EGBs jumped on the weak data, as it diminishes the chances of further Fed rate hikes. So did the metals, with gold adding 0.97% to silver’s 1.17%. I still believe gold will soon touch $1,300 before moving on to test the $1,350 level. Supporting that fair-weather thesis for gold is the stock market. After having reached a mammoth token high with very little in terms of intrinsic worth to justify it, the market should begin to take the news and its own lofty valuations a little more seriously – with some “profit-taking,” to start.

Best Regards,

David Burgess

VP Investment Management

MWM LLC