Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Warning Shots Fired, Stock Valuations in the Crosshairs

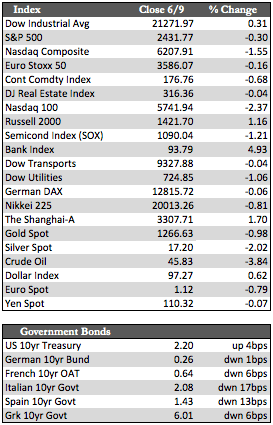

Stocks closed out the week in mixed fashion. The Dow Industrials and S&P 500 managed a fractional gain while the NASDAQ was under siege and declined around 2.0%. What triggered the divergence in the indices is not entirely clear; the drop in the NASDAQ (on Friday) came as a surprise to most traders and the media. Goldman Sachs reportedly believes that tech stocks have reached a potential “valuation air pocket” where prices have advanced further than can be justified by the underlying fundamentals. Shares of high-flying FANGs were affected most by the opinion, each losing a little over 3.0% on average. Some say that disappointment surrounding Apple’s soon-to-be-launched iPhone 8 and a possible EU anti-trust blockage of Qualcomm’s acquisition of NXP Semiconductor also weighed on tech shares. However, as regular readers of this recap know, these markets are extremely vulnerable already given the intense amount of leverage moving prices behind the scenes.

As to why the Dow and S&P did not fall with tech shares, there was some flight to quality (or to the relatively undervalued), which benefited blue chips to some degree, as well as financials and energy. I find the rotation into financials somewhat odd because the industry just announced its earnings will take a 10% hit in the upcoming quarter due to a slowdown in lending. Perhaps traders felt that that fact had already been discounted. In any case, whether this selloff bleeds into higher quality stocks and extends beyond certain technical barriers (Dow 20,866.19, NASDAQ 5,608) is unknown at this point. Any contact with the moving averages is bound to inspire some sizeable “bounces.”

As to why the Dow and S&P did not fall with tech shares, there was some flight to quality (or to the relatively undervalued), which benefited blue chips to some degree, as well as financials and energy. I find the rotation into financials somewhat odd because the industry just announced its earnings will take a 10% hit in the upcoming quarter due to a slowdown in lending. Perhaps traders felt that that fact had already been discounted. In any case, whether this selloff bleeds into higher quality stocks and extends beyond certain technical barriers (Dow 20,866.19, NASDAQ 5,608) is unknown at this point. Any contact with the moving averages is bound to inspire some sizeable “bounces.”

Away from stocks, Treasuries remained weak, driven by supply concerns ahead of next week’s auctions and the upcoming debt ceiling increase. Oil remained surprisingly subdued amid a diplomatic spat between Middle Eastern energy producers and a streak of terror attacks that claimed the lives of 200+ over the past two weeks. The crude price closed out at roughly 45 and change. At that level, we just might see some renewed profit pressure among US firms – but I may be premature in that belief.

The dollar gained some ground, mostly against the euro. In a meeting Thursday morning, the ECB remained unchanged in policy, maintaining a deposit rate of -0.4% for banks, a base interest rate of 0.0%, and a quantitative easing program of up to €60 billion per month. Dollar strength weighed on the metals, as did some post-terror selling, I suspect, as gold shed about a percent to silver’s 1.37%.

The results of Comey’s Senate hearing and Britain’s elections were largely expected by the markets and therefore had no visible impact on the price action in stocks. Comey’s written statement exonerated Trump from any criminal wrongdoing: Neither Trump nor anyone from his administration attempted to persuade the FBI to drop the investigation into alleged Russian tampering with US elections. Case closed, I hope. Next week, we have another FOMC policy meeting in which another rate hike is expected – despite the shortfall in jobs last week. Rate hike or no, at these levels/valuations the effect on stocks should prove inconsequential.

Best Regards,

David Burgess

VP Investment Management

MWM LLC