Here’s the news of the week — andhow we see it here at McAlvany Wealth Management:

Fed Remains on Course – One More Rate-Hike Expected in 2017

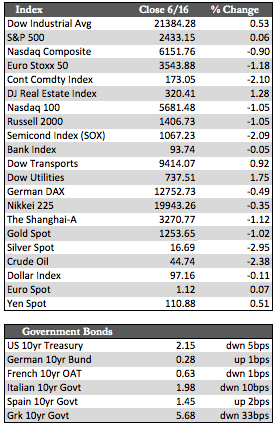

This week’s stock market action could generally be split into two parts – pre-and post FOMC. Ahead of the Fed, stocks melted up on the outside chance the Fed would turn dovish. After the meeting, stocks foundered as the Fed turned out to be more hawkish than expected. The Fed raised the target rate by 0.25% to 1.25%, and gave high marks (as usual) to the economy, inflation, and jobs, claiming that whatever weakness we have seen in the economy will prove to be transitory. Still, the Fed meeting didn’t amount to much in terms of its impact across the board – yet. Tech was sold predominantly, while the “blue-chip” Dow Industrials were bought – but I believe this was an extension of the theme that began last week. In that theme, tech stock valuations are called into question relative to stocks in the Dow that are still thought of as a win-win on the basis not only of valuation, but also Trump’s yet-to-be-detailed fiscal spending initiative ($1 trillion over 10 years). Overseas stock indices, unlike the Dow here in the US, were seen struggling away from their highs – please see the box scores.

On the economic front, the “transitory” data, as the Fed put it, was as follows: In May, US retail sales were off 0.3%, both the PPI (0.0%) and CPI (-0.1%) were essentially flat, and industrial production declined to 0.0% from 0.3% in April. Preliminary manufacturing surveys for June (Empire, Phili, and SIC) showed mixed results at best. Jobless claims in the week ending June 10 were rangebound (as they have been since February) at 237,000. It may also be worth mentioning that Japan’s machinery orders were down 3.1% in April (+0.5% was expected) and Canadian existing home sales were off 6.2% in May.

On the economic front, the “transitory” data, as the Fed put it, was as follows: In May, US retail sales were off 0.3%, both the PPI (0.0%) and CPI (-0.1%) were essentially flat, and industrial production declined to 0.0% from 0.3% in April. Preliminary manufacturing surveys for June (Empire, Phili, and SIC) showed mixed results at best. Jobless claims in the week ending June 10 were rangebound (as they have been since February) at 237,000. It may also be worth mentioning that Japan’s machinery orders were down 3.1% in April (+0.5% was expected) and Canadian existing home sales were off 6.2% in May.

Aside from these things, there isn’t much else worth commenting on. I still believe the market action is suggesting a significant correction in the stock market is ahead of us. Treasuries were a bit firmer for the 11th straight week. The gains weren’t much to speak of, but the trend supports the notion we are headed for a bout of “deflation,” as its now called. Whether that turns out to be a 5.0% or 10.0% correction in prices (in the Dow or S&P) one can’t be sure, but I am fairly certain buyers will show up to “buy the dip” before we see the market roll over in earnest. At any rate, I suspect gold will behave a bit better from here. It didn’t hit $1,300 as I thought it would. It came close as it touched on $1,294 before it was led lower to the $1,250 area by post-terror and FOMC selling pressure. But at these levels the indicators are flashing green again, so we should see gold take another stab at $1,300 starting as soon as next week.

Best Regards,

David Burgess

VP Investment Management

MWM LLC