Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

The End of a Dull Week

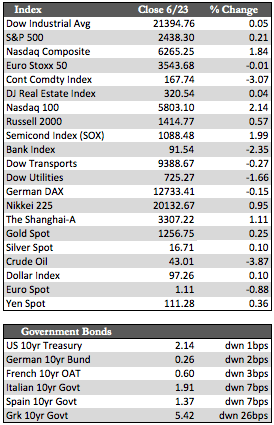

To start the week, stocks here and abroad bounced on rumors that the PBoC and the BoJ would resort to more quantitative easing to support their markets. As it turned out, China committed to stimulus that totaled 120 billion yuan, while the BoJ simply maintained its current pledge of 80 trillion yen per year. The latter came as a disappointment to the bulls, as did the general lack of dovish talk from Fed speakers Bullard, Mester, and Powell during the week. Accordingly, the indices lost some of their early momentum and closed the week in mixed fashion – absent the usual record highs. The Dow, Dow Transports, and S&P 500 were relatively unchanged, while the NASDAQ added nearly 2.0% on okay results from Oracle, some drug approvals in biotech, and hope for more uninterrupted growth in semiconductors (think AI and self-driving auto). That said, I would still describe the action in stocks as slightly out of character. They seemed uninspired by the usual stimulants (i.e., Trump news) and unable to build on any momentum – including the NASDAQ rallies.

Away from stocks, a flight to safety was evident. Treasuries advanced again as the recent softness in inflation gauges (CPI, PPI) reduced expectations of further Fed rate hikes. Crude oil was shellacked over renewed supply side (“glut”) concerns, while both the metals and the dollar managed small gains (see the scores). On the economic front, we saw some improvement (though marginal) in the data that could be attributed to the 40 basis point decline in long-term rates over the last month or so. May housing starts and permits declined 5.5% and 4.9% respectively – which represented the worst of it. Existing home sales added 1.1% to 5.62 million homes and new home sales tacked on 2.9% to 610,000. In June, mortgage applications were up 0.6% (in the 2nd week), and preliminary manufacturing/service data was a bit lower. However, indicators remained comfortably above 50 in a range between 52 and 53 (a read below 50 implies recession).

Away from stocks, a flight to safety was evident. Treasuries advanced again as the recent softness in inflation gauges (CPI, PPI) reduced expectations of further Fed rate hikes. Crude oil was shellacked over renewed supply side (“glut”) concerns, while both the metals and the dollar managed small gains (see the scores). On the economic front, we saw some improvement (though marginal) in the data that could be attributed to the 40 basis point decline in long-term rates over the last month or so. May housing starts and permits declined 5.5% and 4.9% respectively – which represented the worst of it. Existing home sales added 1.1% to 5.62 million homes and new home sales tacked on 2.9% to 610,000. In June, mortgage applications were up 0.6% (in the 2nd week), and preliminary manufacturing/service data was a bit lower. However, indicators remained comfortably above 50 in a range between 52 and 53 (a read below 50 implies recession).

Even as we head into a season marked by corporate pre-announcements (for second quarter earnings), I believe the momentum in stocks will depend more upon the effectiveness of Trump policies. I say that in light of the fact that the price gains we have seen since the election more than offset anything earnings (whether artificially derived or not) can justify. It will be interesting to see how stocks perform over the coming days/weeks as Congress works through some very difficult legislation given our deficit status. That sentiment also holds for other defensive areas of the market – including bonds, the dollar, and the metals.

Best Regards,

David Burgess

VP Investment Management

MWM LLC