Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bond Markets Take a Beating

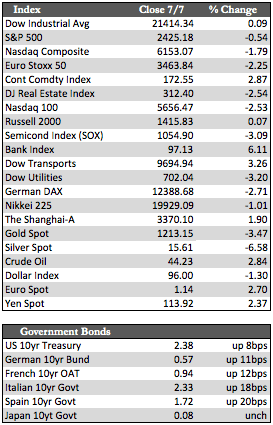

Considering the damage done to bond markets around the world this week, it was surprising to see the US stock market hold its own and eke out a small gain. Check the box scores for specific numbers, but the short version is that if it weren’t for the low-volume (half the usual) holiday explosion in stock prices Monday, equities would most likely have finished in the red. ECB minutes released on Thursday showed that there was some discussion about removing the easing bias from their bond-buying program. No one knows exactly how much or over what time frame they would actually execute such a plan, but the mere fact that they are concerned about QE and its effects sent a small chill up the spine of bond traders. European government bonds (EGBs) experienced some fairly significant changes, with the German 10-year Bund suffering the most technical damage vis-à-vis other EGBs, but not the most in terms of a move in yield (see the scores). I’ve said it before, but if traders begin to realize that underlying this central bank hawkishness is an inept QE program that’s lost its ability to foster profitable growth via manipulating borrowing rates lower, stocks – not just bonds – will begin to behave differently.

In the backdrop, I suspect stocks were supported by fairly decent (or favorably interpreted) economic information. In the month of May, European services and US manufacturing data showed stable results, though a US ISM prices-paid component dropped from 60.5 to 55.0. A well-hyped but low-quality non-farm payroll number of 222,000 on Friday helped erase losses in stocks generated by North Korean ICBM concerns on Wednesday. Aside from this, we had a few mergers (such as Vantiv) and news that US auto sales in June came in a bit “better than expected.” To be clear, GM sales were DOWN 4.7%, Ford 5.0% and Chrysler 7.0%. The gains in June, if any, came from Japan – primarily from sales of low-end SUVs.

In the backdrop, I suspect stocks were supported by fairly decent (or favorably interpreted) economic information. In the month of May, European services and US manufacturing data showed stable results, though a US ISM prices-paid component dropped from 60.5 to 55.0. A well-hyped but low-quality non-farm payroll number of 222,000 on Friday helped erase losses in stocks generated by North Korean ICBM concerns on Wednesday. Aside from this, we had a few mergers (such as Vantiv) and news that US auto sales in June came in a bit “better than expected.” To be clear, GM sales were DOWN 4.7%, Ford 5.0% and Chrysler 7.0%. The gains in June, if any, came from Japan – primarily from sales of low-end SUVs.

Away from stocks, Treasuries fell in sympathy with EGBs, the dollar benefitted from a little flight-to-safety action consequent to North Korea’s antics, and crude oil took another nose dive – as did the metals, with gold off 2.28% to silver’s 6.08%. Somewhere along the way, folks have convinced themselves that higher rates (long or short) are bad for the gold price, and I think that’s what triggered the panic-stricken technical selloff past the $1,237 level for gold. I don’t believe the higher rates = lower gold theory holds any water whatsoever, and once the fair-weather fans are through selling, we should see gold resume an upward bias built upon ongoing dollar weakness and/or increasing credit risks.

Best Regards,

David Burgess

VP Investment Management

MWM LLC