Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

What? Stocks Worry?

In the midst of a slew of controversial news, stocks still managed a decent gain on the week as they climbed the proverbial “wall of worry.” Of course, stock prices don’t climb on concerns and worries as much as they do on liquidity. That’s exactly what traders have come to expect, now that they’ve finally embraced the fact that the US economy has slowed or possibly even entered into a contraction. Helping that revelation along this week was a rather benign reading from the Consumer Price Index (0.0% MoM) and a negative 0.2% drop in retail sales for the month of June. Strictly by the numbers, worse has been seen, but I believe word had it that consumers weren’t chasing after goods and services even after deep discounts were offered. In any case, I believe that, combined with anemic bank profits, the growing perception that Washington is gridlocked, and a chorus of dovish “to the rescue” remarks from Janet Yellen, JP Morgan CEO, Jamie Dimon and Goldman Sachs chief economist Jan Hatzius, stocks were thoroughly whipped into rally mode, propelled by what I am sure was a fair amount of short covering.

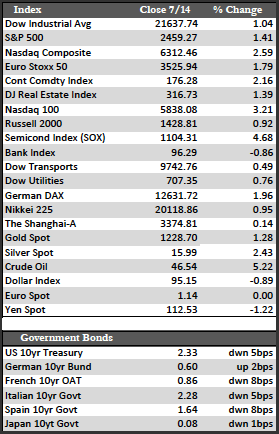

Away from stocks, Treasuries were essentially flat and gained very little on the prospect of a more dovish Fed. Crude oil caught a bid once again on the loosely held belief that the industry “isn’t in such bad shape.” The dollar fell to a new low for the year, which helped the metals find their footing. Gold broke out above its 200-day moving average of $1,226.48 to $1,228.70 and silver showed some promise, rallying from the doldrums a few percent to $15.99. Overseas stocks rallied in sympathy with US counterparts, but EGBs were seen sliding again, unable to gain any traction even in the wake of American-generated “dovish” optimism.

Away from stocks, Treasuries were essentially flat and gained very little on the prospect of a more dovish Fed. Crude oil caught a bid once again on the loosely held belief that the industry “isn’t in such bad shape.” The dollar fell to a new low for the year, which helped the metals find their footing. Gold broke out above its 200-day moving average of $1,226.48 to $1,228.70 and silver showed some promise, rallying from the doldrums a few percent to $15.99. Overseas stocks rallied in sympathy with US counterparts, but EGBs were seen sliding again, unable to gain any traction even in the wake of American-generated “dovish” optimism.

Again, I am beside myself when watching stocks attempt a moon shot from these levels based on the prospect of more easy money when it’s been clear that easy money policies everywhere are backfiring. QE of $1.8 trillion a year is injected into markets worldwide, yet rates continue to rise and economies continue to founder. Granted, the relationship between QE and trading activity here in the States could be described as “Pavlovian” over the last few decades, but lately this dysfunction has reached astoundingly ignorant levels as the fundamentals around that trade have deteriorated from all sides. In that, I submit that this rally is running on borrowed time (to say the least) and is long overdue for a reality check. But for now, defensive assets (i.e., the metals) are limited to small gains in light of the charade ongoing in stocks.

Best Regards,

David Burgess

VP Investment Management

MWM LLC