Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

North Korea Didn’t Create the Bond Bubble

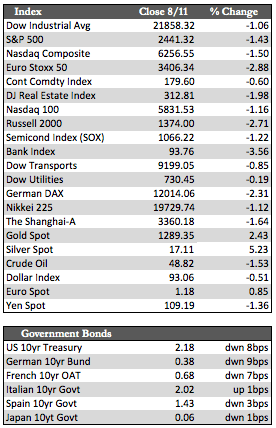

This was predominantly “risk off” week as a wave of selling swept through the markets in the wake of nuclear threats emanating from North Korea. Though the selling was more controlled in the States than in overseas markets, the losses in equities were about double. Technically speaking, the US indices have yet to suffer any real technical damage (unlike in Asia and Europe) that would cause one to believe that stocks are ready to take a tumble. That could change in an instant, given the highly leveraged and/or speculative underpinnings evident in this market. That said, North Korea could quite possibly prove to be the catalyst that sets things off, but it wouldn’t be the actual cause. Earnings this quarter (second quarter 2017) are still lower than where they were in the comparable quarter of 2014, yet, as I have mentioned here before, stocks are 25.0% higher today. Leverage is the key to that dynamic, and because prices have moved without earnings there is now a great deal of unsupported debt or “hot money” in the market that can vanish quickly if the momentum fades.

Along those lines, several of the so-called speculative favorites in addition to the FANGs (ex Facebook, perhaps) have seen their stock prices fade from record highs or languish post-earnings. That would lead me to believe that speculative forces are growing weary, but I really don’t want to draw any firm conclusions from the price action quite yet. This would include Disney, Priceline, and Nvidia shares, which suffered sharp setbacks even after “beating” estimates. I would also argue that this type of price action existed long before North Korea became an issue. Credit card companies, on the other hand, are doing quite well, but I am not entirely sure that’s a positive for the US in the long run. US Credit card debt rose to a record $1.02 trillion in June of this year.

Along those lines, several of the so-called speculative favorites in addition to the FANGs (ex Facebook, perhaps) have seen their stock prices fade from record highs or languish post-earnings. That would lead me to believe that speculative forces are growing weary, but I really don’t want to draw any firm conclusions from the price action quite yet. This would include Disney, Priceline, and Nvidia shares, which suffered sharp setbacks even after “beating” estimates. I would also argue that this type of price action existed long before North Korea became an issue. Credit card companies, on the other hand, are doing quite well, but I am not entirely sure that’s a positive for the US in the long run. US Credit card debt rose to a record $1.02 trillion in June of this year.

Away from stocks, safe havens were active as Treasuries and the metals gained on the weakness in stocks. Yields are near their mid-June lows for the year, with the 30-year Treasury at 2.78% and 30-year mortgage at 3.78%. Gold added 2.4% and silver a cool 5.25%. The dollar, however, continued to fall, this time in response to the rather benign PPI (-0.1%) and CPI (0.1%) data for the month of June. Next week we’ll know just how far North Korea intends to take its threats. Tuesday the 15th marks the day Kim Jong-un promised to launch in the direction of Guam, so we’ll see both Trump’s and the market’s response to these and other events as they unfold.

Best Regards,

David Burgess

VP Investment Management

MWM LLC