Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Tax Cut + Spending = Increased Debt Ceiling

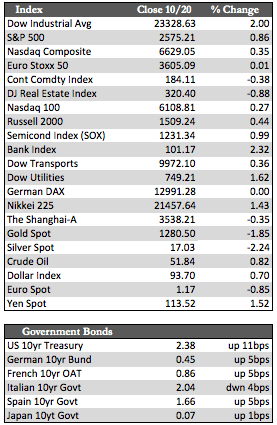

The Senate approved a budget bill today that supposedly calls for $1.5 trillion in tax cuts (for corporate and middle class) and increases in spending (i.e., defense). The bill still needs approval by the House, but once that occurs I believe Senate Republicans will need only 51 votes (not the usual 60), essentially fast-tracking the bill in the final vote. The entire process could be completed by year-end 2017 or, more likely, in the early months of 2018. Keep in mind that talk about this bill started early in the week, and I believe its development was primarily responsible for the resilience in stocks to any bad news and/or attempts at profit taking. Instead the Dow posted a most decisive new high, adding nearly 460 points to 23,328.63, aided by a fairly outsized dead-cat bounce in IBM. In contrast, the NASDAQ and S&P 500 lagged behind due to Apple, as it cut orders to its suppliers by as much as 50% over sluggish sales in its newly launched iPhone 8. Shares overseas were also held to modest gains after the Chinese Central Bank warned about escalating household and corporate debt levels.

Away from stocks, most fixed income was lower, which pushed yields into the higher end of the range for the year. The dollar was higher, but not noticeable stronger, while the metals retreated to the lower end of the trading range, with gold settling in at $1,280 and silver at $17.03. Losses in the metals appeared controlled as downside volumes in the ETFs remained within the norm. Crude oil was unchanged, as were commodities in general, ex agriculture on healthy supply-side activity this harvest. As for the economic data, we continue to see the well-anticipated uptick in manufacturing data (post storm) but have yet to see the same in the housing data. Housing starts (-4.7%), building permits (-4.5%), and existing home sales (+0.7%) remained well off pre-storm highs.

Away from stocks, most fixed income was lower, which pushed yields into the higher end of the range for the year. The dollar was higher, but not noticeable stronger, while the metals retreated to the lower end of the trading range, with gold settling in at $1,280 and silver at $17.03. Losses in the metals appeared controlled as downside volumes in the ETFs remained within the norm. Crude oil was unchanged, as were commodities in general, ex agriculture on healthy supply-side activity this harvest. As for the economic data, we continue to see the well-anticipated uptick in manufacturing data (post storm) but have yet to see the same in the housing data. Housing starts (-4.7%), building permits (-4.5%), and existing home sales (+0.7%) remained well off pre-storm highs.

Tax and/or fiscal spending reform are really red herrings in my opinion – for several reasons, some of which have been mentioned here before. Simply put, while at the top end of an economic cycle (so-called), with a deficit of nearly $600 billion this year and no offsetting spending cuts, the deficit stands to increase by just as much as the proposed tax-cut itself – in this case, $1.5 trillion. Which means Uncle Sam will by necessity need to borrow a sum equal to that amount, if not more, as a certain portion of folks will always choose to save rather than spend. Additionally – and this is a bit more complicated to explain – if stocks are up nearly 30%, food and homes up over 5.0%, and oil up 14.8%, among other increases since the election, what good is a tax cut? I’m already paying much more for everything I need to live on and prosper. Thank you, Wall Street. Your ability to speculate at the average Joe’s expense is remarkable, and yet you ask for more flexibility and less reform?

Best Regards,

David Burgess

VP Investment Management

MWM LLC